|

July 2010 | Volume 2/Number 4

Feature Story

What's Up with IMS? It’s Anyone’s Guess, But Buckle Your Seat Belts

As a whole, however, there have been very few IMS deployments worldwide, with only about 8 percent of networks today based on the architecture, says Micaela Giuhat (News - Alert), vice president of product marketing with GENBAND, which Infonetics ranks No.1 in the carrier VoIP and IMS equipment space. "IMS is not here yet. It will be. But it will take a while," says Giuhat, adding that GENBAND (now with the Nortel (News - Alert) CVAS acquisition under its belt), is helping carriers migrate to the architecture and other next-generation environments. She and Mehmet Balos, executive vice president and chief marketing officer with GENBAND (News - Alert), note that while some carriers (like Verizon) will leap from TDM to IMS, most (among them AT&T) will migrate to it more gradually in an effort to better manage capital expenditures. Infonetics forecasts that between this year and 2014 service providers worldwide will invest $4.4 billion on IMS equipment. And while 64 percent of IMS core equipment today is used in wireline deployments, the research firm indicates mobile is what's really creating new momentum around IMS at this point. It expects continued adoption of VoIP; LTE, for which deployments are expected to start in 2012 and ramp up in 2014; and the introduction of more and additional enhanced mobile services involving IM, video, the Rich Communications Suite and the like to be the key drivers of IMS going forward. Martin Taylor, who's in charge of product strategy for the carrier systems division of Metaswitch Networks, says the advantage of IMS is most obvious to service providers with both wireline and wireless networks. Such carriers can use the architecture to converge those networks, delivering the same services and applications over both their wireline and wireless infrastructures, he says. Of course, incumbent telcos traditionally have used the intelligent network architecture to support features and services over their networks, he notes, but that's an expensive and outdated way to do things. So instead, service providers are now taking SIP application server products and in some cases adapting them to work with legacy switches. To make that work, he explains, you need a service broker. Metaswitch recently purchased service broker supplier AppTrigger Inc. to enable it to deliver that capability to its carrier customers. Speaking of wireless as it relates to IMS, Vince Lesch (News - Alert), CTO of Tekelec, notes that AT&T, Verizon and others recently came out with a specification known as One Voice, which addresses how to support voice and other services over LTE networks using the IMS architecture. A document on One Voice dated November 2009 says the spec was produced by Alcatel-Lucent, AT&T, Ericsson, Nokia, Nokia Siemens Networks, Orange, Samsung, Sony Ericsson, Telefonica, TeliaSonera, Verizon and Vodafone (News - Alert). The main body of the One Voice profile is applicable for a scenario in which IMS telephony is deployed over LTE in a stand-alone fashion without relying on any legacy infrastructure, packet or circuit switched, according to the same paper. Lesch says that work from this group subsequently was endorsed by other carriers and moved into the GSMA (News - Alert), which he says continues to evolve the spec by addressing additional issues such as roaming. However, while it continues to evolve, he says One Voice is fairly complete, so offers a nice roadmap for vendors. Nonetheless, it will still be a couple of years until we see IMS really being used in such scenarios because initial LTE deployments will be data only services to smartphones and data cards for PCs. "We're cautiously optimistic that the carriers are moving forward with IMS," says Lesch. "It's going to be gated by the availability of handsets, which is expected in 12 to 18 months. Again, how quickly carriers will move is still a matter of great speculation." The uncertainty around IMS implementation may have something to do with the level of complexity involved. Pretty much since the inception of this new architecture, folks have been referring to that challenge. Part of the complexity of the new network paradigm, according to Nakina (News - Alert) Systems CEO Jay Borden, is that while most networks traditionally have had the intelligence at one centralized place, new distributed models mean there are hundreds of devices that need to be maintained. CTO Doug Bellinger of Nakina Systems (News - Alert) adds that to address that carriers need secure access and single sign on, so only those who are authorized to touch certain parts of the network are able to do so; inventory discovery and reconciliation solutions, which do data mining and provide a way to compare data on what gear exists and with what capacity and performance; and a network integrity controller, which compares what's actually happening on the network – in terms of security parameters, changes in routing tables, etc. – to what's supposed to be happening.  Of course, the idea that networks need better inventory and performance

tracking capabilities has been circulating for years. What's new here, according to Borden, is that networks used to be more hardware-based but are now evolving to more of a software-centric model. That means now, in software, there can be hundreds of thousands

of settings per device, and orders of magnitude greater devices to manage, so it's way more complex.

"There's a new operations paradigm that's needed to accompany the new network paradigm," he adds. Yet operations is always an afterthought,

he concludes. Of course, the idea that networks need better inventory and performance

tracking capabilities has been circulating for years. What's new here, according to Borden, is that networks used to be more hardware-based but are now evolving to more of a software-centric model. That means now, in software, there can be hundreds of thousands

of settings per device, and orders of magnitude greater devices to manage, so it's way more complex.

"There's a new operations paradigm that's needed to accompany the new network paradigm," he adds. Yet operations is always an afterthought,

he concludes.

That doesn't have to be the case. Dave Kresse (News - Alert), CEO with testing company Mu Dynamics, says one thing network operators can do to manage the complexity of IMS is test the communications between different network components before putting them into production networks. But rather than doing that using canned test cases as has been the traditional practice, he says, carriers should use solutions that take actual traffic from an environment like the one they're trying to build to get a sense of what the real performance will be. That's important, Kresse says, given every IMS core is and will be slightly different. If service providers don't do that, he adds, they run the risk of having performance issues, such as dropped calls, and thus the potential to frustrate or lose their customers. And that, of course, would be extremely counterproductive, given the move to IMS is largely fueled by carriers' desire to more quickly bring new services to market faster in an effort to stem churn and drive up ARPU. NGN Magazine Table of Contents |

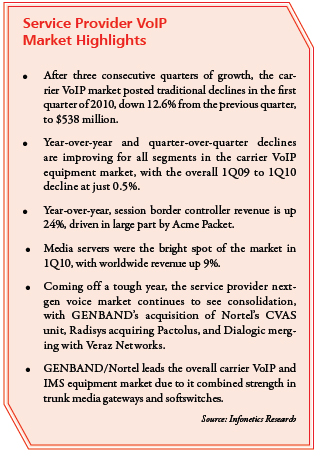

IMS has been on a rollercoaster ride, alternately reaching riveting highs and thundering lows in popularity. Indeed, investment in such infrastructure

frequently spikes and plummets from one quarter

to another, according to Infonetics Research (

IMS has been on a rollercoaster ride, alternately reaching riveting highs and thundering lows in popularity. Indeed, investment in such infrastructure

frequently spikes and plummets from one quarter

to another, according to Infonetics Research (