Most important consumer innovations take some time to be adopted by half of U.S. households. Banking innovations take even longer. In fact, it can take 10 to 20 years for an important consumer banking function to be adopted by half of U.S. households. So even though “there has never been a more exciting time in payments,” as Dave Talach, vice president of global product management at Verifone, recently said, some circumspection is in order.

Mobile payments will not happen in a massive way this year, and it’s not going to happen next year, Talach said. It may not even happen the year after that, as extensive field trials have to be conducted to make sure phones with NFC (near-field communications) technology work properly with merchant terminals and back-end payment-processing systems before any of this can hit the mainstream. Beyond that, there is history to contend with.

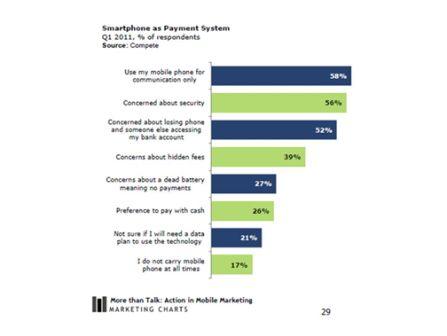

There is the not insignificant matter of consumer acceptance. Consumers who said they were not likely to use their phone for payments cited personal preferences and concerns about security as reasons, according to a survey sponsored by HubSpot and conducted by Watershed Publishing, to name just one obstacle.

Some 58 percent preferred to only use their mobile phone for communication (calls, email, or text) while 56 percent indicated they were concerned with the security of using the phone for payments (more than one answer permitted) and 52 percent were concerned about security if they lost their phone.

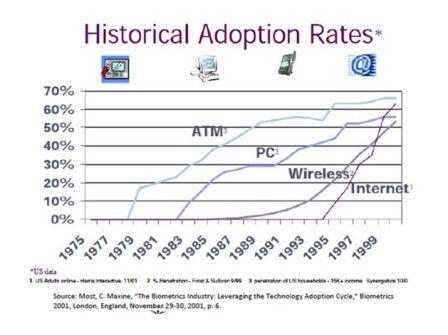

That shouldn’t be surprising. It can take quite a while for payment innovations to take hold. In the United States, it took about a decade for use of automated teller machines to reach about 50 percent penetration of households.

After 20 years, the percentage of U.S. households using automatic bill paying is still only about 50 percent. Likewise, after 20 years, use of debit cards by U.S. households is only about 50 percent. The takeaway is that payments innovation tends to be a rather deliberate process, with adoption processes that take between 10 years to 20 years to reach 50 percent of consumer households.

Why Mobile Payments Might Still Be A Few Years Away

Gary Kim (News - Alert) is a contributing editor for TMCnet. To read more of Gary’s articles, please visit his columnist page.

Edited by Rich Steeves