The announcement today that Ericsson (News - Alert) will aquire 100% of Telcordia (News - Alert) (News - Alert) from Providence Equity Partners (News - Alert), LLC and Warburg Pincus (News - Alert) for $1.15B while not shocking, given all of the rumors that have circulated since Telcordia was put up for auction, does raise some interesting questions. Not the least of which are:

- Is this a good deal financially?

- Does this make sense strategically?

The answer to the question one is, we shall see. The answer to the second is a “big probably.” While this may seem like hedging one’s bets, it is worth taking a brief look. But, first a bit of housekeeping.

I am a network plumbing bigot/evangelist. I have long-time enthusiasm for the “InfoStructure” business —planning, designing, consulting, implementing, maintaining and managing the software, hardware and services that enable public network service providers and enterprises to maximize the value of their network assets in a utilitarian as well as utility manner. Plus, plumbers make good money.

In the name of full disclosure, I was a marketing and communications executive at Telcordia in a previous life.

That said, it seems useful to focus on not just the obvious but some other aspects of this deal.

Is this a good deal financially?

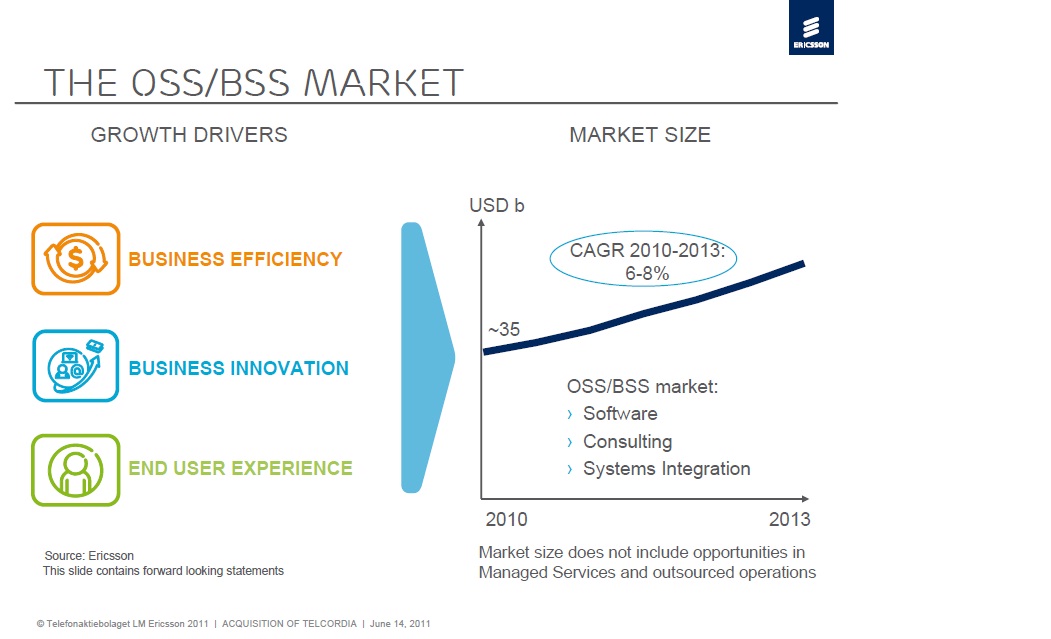

The Wall Street Journal article trumpeted “Ericsson-Telcordia Deal: Private Equity Owners Lucky to Get Out.” However, maybe the “smart money” got out too early. Hans Vestberg, President and CEO, Ericsson, cited numbers indicating that the global OSS/BSS market for software and systems integration in 2010 is about USD $35B. It is expected to show compound annual growth of 6-8 percent between 2010 and 2013. And, this does not include what he asserts is an attractive market for outsourced and hosted managed services, growing at roughly the same. Does this sound like the right time to sell a well-positioned asset?

The Wall Street Journal article trumpeted “Ericsson-Telcordia Deal: Private Equity Owners Lucky to Get Out.” However, maybe the “smart money” got out too early. Hans Vestberg, President and CEO, Ericsson, cited numbers indicating that the global OSS/BSS market for software and systems integration in 2010 is about USD $35B. It is expected to show compound annual growth of 6-8 percent between 2010 and 2013. And, this does not include what he asserts is an attractive market for outsourced and hosted managed services, growing at roughly the same. Does this sound like the right time to sell a well-positioned asset?

If you buy the argument on growth, which I do, $1.15B seems like a small price for Ericsson to pay. Think of the following:

- The synergies between the two companies are clearly significant

- The value of being deeply embedded in the plumbing of the “RBOC” business in the U.S. to a company with minimal account penetration on multiple levels, is impressive

- Legacy systems (and I am not talking about the #SS7 ones the financial analysts love to noodle, but the old standbys like TIRKS®, COMMON LANGUAGE® the LERG®, Telcordia® Number Portability Clearinghouse) all contribute important revenues with decent margins in markets with high barriers to entry and limited competitors.

To the latter point, as TMCnet covered just a few weeks ago, Telcordia announced it will aggressively seek a coveted spot (three are expected) as one of the Local Number Portability Administrators (LNPAs). It has been 15 year in waiting, and one can only speculate as to the valuation placed on this multi-hundred million dollar opportunity.

While basically pooh-poohed by Mark Greenquist, President and Chief Executive Officer, Telcordia, the value of the company’s IP is not merely in pull-through of its current product line. In fact, as a company which may have written more lines of code than any other in the world (OSS/BSS really is that complicated) with a huge IP portfolio behind it, having an advantage procuring government network security work because its workforce is more “home grown” than most competitors, an internationally respected services force and more, Telcordia has significant, critical and defensible IP in terms of patents and people.

Not a bad upside when taken as a whole. Certainly reason to call Ericsson and not the private equity guys “lucky.” The downside is that going back to its BellCore days (when the company was a few billion in revenue larger with a workforce to match), Telcordia has been under the microscope of analysts trying to place a value on it. It is hard to ignore:

- The start-ups it allowed to prosper in spaces they should have owned —Neustar and Amdocs being the headliners

- Failure to make Telcordia®® COMMON LANGUAGE a global standard for labelling, finding and tracking equipment

- Allowing customers to use maintenance and upgrade contracts as leverage to lower profitability rather than use Telcordia’s expertise and knowledge base as a counter weight in negotiations where the customers really had no alternatives

- Failure to successfully integrate (people) or grow revenues and market share of next generation capabilities from acquisitions

- Less than shark-like sales and marketing —an opinion shared by many and not just mine

- A less than spectacular penetration of overseas opportunities during a time of industry growth (then consolidation) in terms of new service providers, physical and virtual. CEO Greenquist may think getting up to 30% of revenues coming from outside North America on his watch is commendable, but 30% of shrunken revenues with years of opportunity to gain share in a dynamic market appears to beg the question

While I lean toward saying Ericsson got a good and possibly great deal, it is tempered by whether they are capable of pulling off what so many others have had difficulty doing. No matter how good the fit seems on paper -- and this one looks good-- integrating operations and cultures, keeping the right and best people while accelerating innovation and keeping customers happy, is always problematic in such deals. And, Ericsson’s record on this front is not spectacularly good.

Does this make sense strategically?

A better question may be one directed at me: “Peter, this makes sense, so why sit on the fence?” My response is there are too many intangibles for an outright yes.

A better question may be one directed at me: “Peter, this makes sense, so why sit on the fence?” My response is there are too many intangibles for an outright yes.

Integration vs. Multi-vendor sourcing

Hans Vestberg believes customers, especially many of the largest, are looking for an “integrated solution” based on the growing complexities where revenue generation will be founded on more tightly integrated OSS with billing systems. History says large operators want to control their own destinies and not rely on the whims of their vendors as “open” as they may appear to be. In the case of Telcordia, the then “Baby Bells”/RBOCs, nixed an IBM purchase of BellCore in favor of non-telecom industry SAIC, who sold the asset to private equity firms once assurances that the biggest customers were okay with this was granted. Multi-vendor sourcing has beauties for customers that are irresistible: leverage on price and leverage on network architecture.

Do the pieces fit?

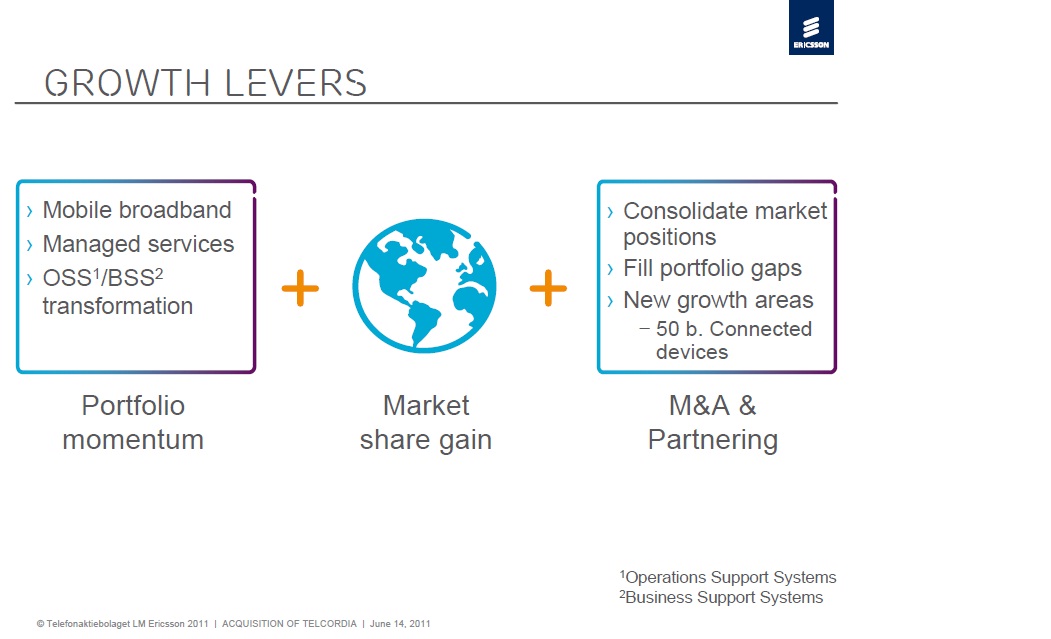

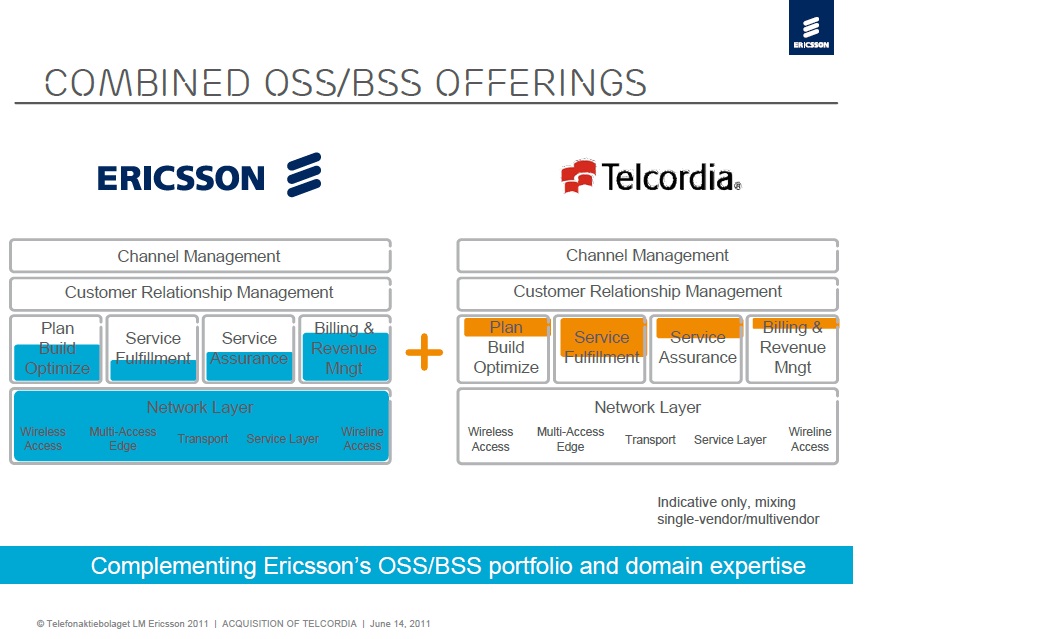

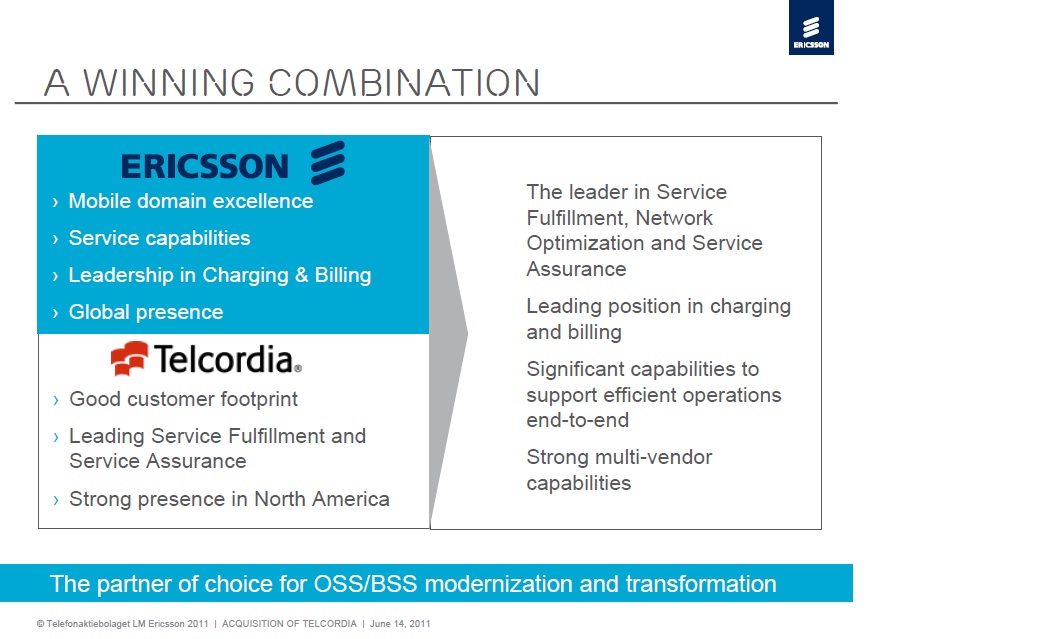

The simple answer is yes. As depicted in two charts from the announcement presentation, Ericsson:

- Has a strategy

- Is aimed at the right opportunities

- Telcordia’s products are complimentary and fill in critical gaps (and with critical customers)

Are there surprises waiting?

Again there is a simple answer. Of course!

With Bell Labs (News - Alert) now part of the Alcatel-Lucent family based out of Paris, ceding foreign control to the entire knowledge base of the legacy plumbing and intellectual property, and possibly a good chunk of the future InfoStructure to foreign owners may be viewed dimly in Washington, D.C. This is non-trivial, particularly given the nature of some of Telcordia’s national security work.

Returning to the patent issue again, for a moment, it is not clear how large the Telcordia treasure chest is. However, if the U.S. Justice Department is concerned about a Canadian company (Nortel’s) IP falling into the wrong U.S. company hands (Google or Apple), how about a U.S. company’s IP falling into foreign hands? One might think Verizon (News  - Alert) and AT&T might have thoughts on the subject.

- Alert) and AT&T might have thoughts on the subject.

This is another part of the continuing drama I like to call, in honor of the late and lamented U.S. TV Soap Opera “As the World Turns V2.0.” Tune in next time for another exciting adventure.

Peter Bernstein is a technology industry veteran, having worked in multiple capacities with several of the industry's biggest brands, including Avaya (News  - Alert), Alcatel-Lucent, Telcordia, HP, Siemens, Nortel, France Telecom, and others, and having served on the Advisory Boards of 15 technology startups. To read more of Peter's work, please visit his columnist page.

- Alert), Alcatel-Lucent, Telcordia, HP, Siemens, Nortel, France Telecom, and others, and having served on the Advisory Boards of 15 technology startups. To read more of Peter's work, please visit his columnist page.

Edited by Rich Steeves