| [February 13, 2024] |

|

Experian Releases 2024 Future of Fraud Forecast

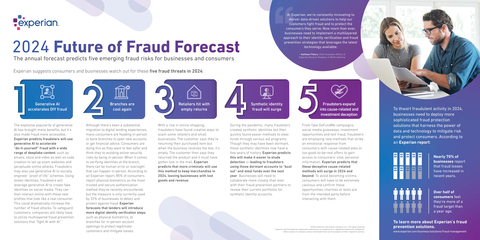

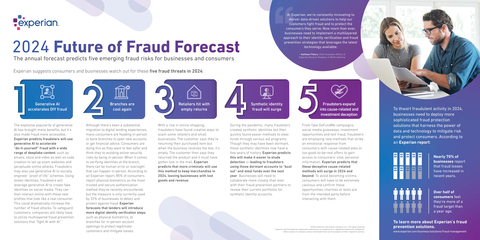

Experian® today released its 2024 Future of Fraud Forecast, which identifies five fraud threats consumers and businesses should be cautious of this year. Today's fraudsters are sophisticated and will deploy the latest technology, such as generative artificial intelligence, to dupe consumers and businesses.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240213237411/en/

Experian's 2024 Future of Fraud Forecast (Graphic: Business Wire)

According to an Experian report, nearly 70% of businesses report that fraud losses have increased in recent years and over half of consumers feel they're more of a fraud target than a year ago. To thwart fraudulent activity in 2024, businesses need to deploy more sophisticated fraud protection solutions that harness the power of data and technology to mitigate risk and protect consumers.

Experian suggests consumers and businesses watch out for these five fraud threats in 2024:

-

Generative AI accelerates DIY fraud: The explosive popularity of generative AI has brought many benefits, but it's also made fraud more accessible. Experian predicts fraudsters will use generative AI to accelerate "do-it-yourself" fraud with a wide range of deepfake content, such as emails, voice and video as well as code creation to set up scam websites and perpetuate online attacks. Fraudsters may also use generative AI to socially engineer "proof of life" schemes. Using stolen identities, fraudsters will leverage generative AI to create fake identities on social media. They can then interact online with these new profiles that look like a real consumer. This could dramatically increase the number of fraud attacks. To safeguard customers, companies will likely have to utilize multilayered fraud prevention solutions that "fight AI with AI."

-

Branches are cool again: Although there's been a substantial migration to digital lending experiences, many consumers are heading in-person to bank branches to open new accounts or get financial advice. Consumers are doing this as they want to feel safer and think they're avoiding online security risks by being in-person. When it comes to verifying identities at the branch, there can be human error or oversight that can happen in-person. According to an Experian eport, 85% of consumers report physical biometrics as the most trusted and secure authentication method they've recently encountered, but the measure is only currently used by 32% of businesses to detect and protect against fraud. Experian forecasts that lenders will introduce more digital identity verification steps, such as physical biometrics, at branches for in-person account openings to protect legitimate customers and mitigate losses.

-

Retailers hit with empty returns: With a rise in online shopping, fraudsters have found creative ways to scam some retailers and small businesses. The customer says they're returning their purchased item but when the business receives the box, it's empty. The customer then says they returned the product and it must have gotten lost in the mail. Experian predicts that more criminals will use this method to keep merchandise in 2024, leaving businesses with lost goods and revenue.

-

Synthetic identity fraud will surge: During the pandemic, many fraudsters created synthetic identities but then quickly found easier methods to steal funds through various aid programs. Though they may have been dormant, these synthetic identities now have a few years of history. Experian predicts this will make it easier to elude detection - leading to fraudsters using those dormant accounts to "bust out" and steal funds over the next year. Businesses will need to collaborate more closely than ever with their fraud-prevention partners to review their current portfolios for synthetic identity accounts.

-

Fraudsters expand into cause-related and investment deception: From fake GoFundMe campaigns, social media giveaways, investment opportunities and text fraud, fraudsters are employing new methods that strike an emotional response from consumers with cause-related asks or too-good-to-be-real offers to gain access to consumers' vital, personal information. Experian predicts that these deceptive cause-related methods will surge in 2024 and beyond. To avoid becoming victims, consumers will have to be extremely cautious and confirm these opportunities, charities or texts are from the intended party before interacting with them.

"The speed and complexity of fraud attacks due to new technology and sophisticated fraudsters is leaving both businesses and consumers at risk in 2024," said Kathleen Peters, chief innovation officer at Experian Decision Analytics in North America. "At Experian, we're constantly innovating to deliver data-driven solutions to help our customers fight fraud and to protect the consumers they serve. Now more than ever, businesses need to implement a multilayered approach to their identity verification and fraud prevention strategies that leverages the latest technology available."

Last year, Experian estimates that its fraud prevention solutions helped clients save more than $12 billion in fraud losses globally. Experian's CrossCore® helps clients verify identities, detect and prevent fraud, and meet regulatory requirements using real-time risk analytics and decision-making strategies. Precise ID® provides real-time identity verification and the ability to identify and treat specific fraud risks, including identity theft, synthetic identity and first-party fraud. Most Precise ID clients see a substantial lift in fraud detection performance compared to their legacy systems.

To learn more about Experian's fraud prevention solutions, please visit https://www.experian.com/business/solutions/fraud-management.

About Experian

Experian is the world's leading global information services company. During life's big moments - from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers - we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organizations to prevent identity fraud and crime.

We have 22,000 people operating across 32 countries and every day we're investing in new technologies, talented people, and innovation to help all our clients maximize every opportunity. With corporate headquarters in Dublin, Ireland, we are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Other product and company names mentioned herein are the property of their respective owners.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20240213237411/en/

[ Back To TMCnet.com's Homepage ]

|