TMCnet News

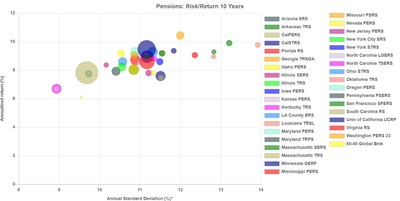

Pension and Endowment Risk Profiles Should be Looked at Closely Given Potential Market Disruption Caused by Silicon Valley Bank, According to Proprietary Research from MPIAfter initial projections on pension and endowment performance from MPI's Transparency Lab, the industry must consider both overall performance and potential risk, given potentials for duration and liquidity mismatches. SUMMIT, N.J., March 23, 2023 /PRNewswire/ -- While pension and endowment funds appear to have rebounded from their losses in FY2022, industry participants should focus more on assessing risks stemming from potential duration bets, as shown in the collapse of Silicon Valley Bank, and also on measuring potential markdowns in illiquid private assets, according to projections from Markov Processes International, Inc. ("MPI"), a leading independent FinTech provider of software and services for analyzing investment performance and risk. Pensions and endowments have more risk than you may think, amid the current banking crisis. "Given the current market environment, now is an especially good time to not simply look at performance in a vacuum but to also consider the cost of the performance, based on the risk a fund takes," said Michael Markov, MPI's co-founder and CEO. "We know that private-market investments are likely to be a drag on pension performance this fiscal year, but the issues surrounding Silicon Valley Bank should prompt fund managers and stakeholders to look more closely at issues like how illiquidity might affect performance." MPI today released its initial projections on pension and endowment performance from its proprietary Transparency Lab, a hub of reports and analytics on pensions and endowments. Performance of the Global 60-40 benchmark for the second half of 2022 was 0.2%, with -6% loss in the third quarter and 6.6% gain in the fourth quarter of 2022, which provides a basis for projections about most pensions' experience. However, given the differences in pensions' asset allocations, both the magnitude of the swing and the end-result vary. According to data from the Transparency Lab, most pension and endowment funds have had similar performance over the past few years but have done so with widely different risk appetites, as measured by standard deviation. For example, the $13 billion Columbia University endowment and the $86 billion North Carolina Teachrs and State Employee's Retirement System have shown historically lower performance than their peers but maintained almost half the risk of some of their high-performing peers. According to MPI's projections, the biggest variable in how pensions are faring is private-market exposure. The lowest estimated performers in the group for the second half of 2022 are state employees' pensions of Washington, Oregon, and Pennsylvania. Interestingly, last fiscal year, these three pensions reported the highest performance in the group. Indeed, Oregon PERS reported a 6.3% gain in FY2022, while most peers lost more than 5% and some lost even more than 10% over the same period. What makes this group of three pensions unique is their outsized allocations to private assets. When pensions report their annual results, they usually use previous-quarter valuations for their private assets: e.g., first quarter private valuations for June fiscal year report. In 2022, that was enough to propel these three funds to the top: Cambridge Associates Private Equity index performance for the first quarter was -0.35% (vs. -5% for the second quarter) and at the same time the second quarter return of the S&P 500 Index was -16.1%. In the last half of 2022, these three pensions will have to absorb the 5% loss for private equity in the second quarter, since it was not counted in the last fiscal year number. Over the year, it has become more difficult for stakeholders to obtain relevant risk exposure details on many U.S. pension funds, which have been plagued by chronic underfunding and decreased disclosure. Even when this information is available, peer-to-peer comparisons are almost impossible because every institution is unique in how it defines asset classes and categories of alternative investments. The MPI approach standardizes allocation types across investors, providing a common denominator for comparison. This data becomes especially important given how broadly exposed pensions could be to Silicon Valley Bank, through the impact on private equity and venture capital investments, Markov said. "Before the release of the Transparency Lab there was no place where stakeholders could compare and assess real market risks of pension portfolios," Markov said. "We believe the public and the marketplace are better served with more transparency, and these projections mark a step toward shining light on the performance, risk, and styles of these important investors." MPI's software utilizes proprietary technology and public data sources to peek, quantitatively, behind the curtain of a wide range of investments, providing information that is often impossible to obtain otherwise. With the Transparency Lab, all that data and analysis is contained in one place and publicly available, allowing investors, beneficiaries, regulators, researchers, journalists, and other stakeholders to garner unique insight into some of the largest and most opaque investors. With the MPI Transparency Lab, registered users can view analytics and download "MPI-360" reports that help them uncover trends in asset allocation and exposures, explain drivers of both recent and historical results, obtain estimates of risks, drawdowns and efficiency, perform historical stress tests, and evaluate various hypothetical scenarios. MPI uses its proprietary Dynamic Style Analysis (DSA) and public annual returns to reverse-engineer asset exposure dynamics of large investor portfolios. When pensions report only annual performance figures, a decade's worth of performance is represented by only 10 data points. Traditional static and rolling-window methods of regression analysis struggle to find credible insights from such infrequent data. MPI's DSA, however, is uniquely adapted to work with such limited data. For additional information on MPI's proprietary data, visit the Transparency Lab. For further information, contact MPI at +1 (908) 608-1558 or [email protected]. About MPI Markov Processes International Inc. (MPI) is a leading provider of solutions for investment research, analysis and reporting to the global wealth and investment management industry. MPI works with more than 200 client organizations, including pensions and endowments, sovereign wealth funds, global wealth management firms, institutional consultants, regulators, investment advisors and asset managers. Rooted in the principles of transparency, objectivity, and efficiency, MPI takes an innovative approach to problem solving in the areas of fund analysis, risk management, asset allocation, and reporting to ensure that its clients have the tools to succeed in ever-more-crowded markets. Follow us on Twitter @MarkovMPI and connect with us on LinkedIn. Contact: [email protected]

SOURCE Markov Processes International, Inc.

|