TMCnet News

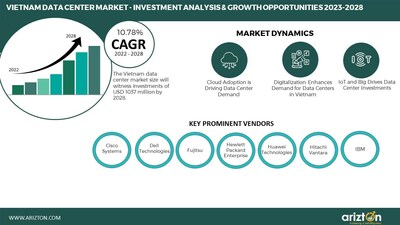

VIETNAM DATA CENTER MARKET TO WITNESS INVESTMENT OPPORTUNITIES OF AROUND $1 BILLION IN 2028; MORE THAN 950 THOUSAND SQ. FT OF WHITE SPACE TO BE ADDED IN THE NEXT 6 YEARS - ARIZTONCHICAGO, March 21, 2023 /PRNewswire/ -- According to Arizton's latest research report, the Vietnam data center market will grow at a CAGR of 10.8% from 2022-2028.

TO KNOW MORE, DOWNLOAD THE FREE SAMPLE REPORT: https://www.arizton.com/request-sample/3732 The government's strategies, digitalization initiatives, expansion of fiber connectivity, and 5G deployment have made Vietnam one of Southeast Asia's emerging data center markets. To achieve e-government, e-economy, and e-society, as well as to increase production and manufacturing, Vietnam's National Digital Transformation Program 2025 aims to accelerate digital transformation. By 2025, this initiative hopes to have moved about 50% of the company's operations online. Major telecom operators and colocation service providers in the Vietnam data center market invest in cloud-based services. In 2022, Vietnam contributed around 4% of data center investments to the total Southeast Asia data center market. The colocation market in Vietnam is one of the fastest-growing markets in Southeast Asia. The shifting of workloads from on-premises to cloud platforms increases the demand for wholesale colocation in the country. VIETNAM DATA CENTER MARKET REPORT SCOPE

LOOKING FOR MORE INFORMATION? DOWNLOAD THE FREE SAMPLE REPORT: https://www.arizton.com/request-sample/3732 MARKET TRENDS In September 2022, HSBC Vietnam provided financial assistance to Viettel IDC, Vietnam's largest data center operator, to construct the data centers using sustainable materials. The financial assistance is available for five years and includes a $16 million investment. The assistance is provided to help Viettel IDC purchase the equipment needed to build data centers in Hanoi with a PUE of less than 1.5. In September 2022, Edge Centers, an Australian edge data center firm, launched the first edge data center in Ho Chi Minh City, Vietnam, where a solar energy source powers the facility. HTC-ITC partnered with Delta Electronics by deploying Vietnam's first certified green data center, Uptime Institute, with a PUE of 1.4, 20% lower than other data centers operating at an average PUE of 1.6 in the country. WHY SHOULD YOU BUY THIS RESEARCH?

EXPLORE OUR LATEST VIETNAM DATA CENTER MARKET DATABASE NOW: https://datacenter.arizton.com/database-report/vietnam-data-centers THE REPORT INCLUDES THE INVESTMENT IN THE FOLLOWING AREAS:

MAJOR VENDORS IT Infrastructure Providers

Data Center Construction Contractors & Sub-Contractors

Support Infrastructure Providers

Data Center Investors

New Entrants

TABLE OF CONTENT Chapter 1 Existing & Upcoming Third-Party Data Centers in Vietnam

Chapter 2 Investment Opportunities in Vietnam

Chapter 3 Data Center Colocation Market in Vietnam

Chapter 4 Market Dynamics

Chapter 5 Market Segmentation

Chapter 6 Tier Standard Investment

Chapter 7 Key Market Participants

Chapter 8 Appendix

CHECK OUT SOME OF THE TOP-SELLING RESEARCH REPORTS: Thailand Data Center Market - Investment Analysis & Growth Opportunities 2023-2028: The Thailand data center market is projected to witness investments of USD 1.33 billion by 2028. The digitalization across the country, availability of tax incentives, deployment of 5G services, and improved connectivity with other Asian countries such as China, Japan, Singapore, Taiwan, and others make Thailand an attractive market for investors. Bangkok is the primary location for data center investment in the country. The construction of Special Economic Zones (SEZs) and Free Trade Zones (FTZs) and infrastructure availability will attract investors to develop facilities in the coming years. Internet Data Center Market in China - Investment Analysis & Growth Opportunities 2023-2028: The Internet data center market in China size by investment crossed USD 29.02 billion in 2022 and is expected to cross USD 34.03 billion by 2028. Technological innovations, rapid growth in demand for digital transformations, and government strategies for the data center industry are among the major driving factors of the market. Global cloud operators such as Microsoft and AWS are setting up their presence in the Internet data center market in China through colocating in local data centers led by the foreign direct investment policy of the country, under which foreign investors must partner with local firms to enter the market. Japan Data Center Market - Investment Analysis & Growth Opportunities 2022–2027: The Japan data center market is estimated to reach USD 13.29 billion by 2027 from USD 8.40 billion in 2021. The country is among the top data center market in the APAC region, after China and Australia, in terms of investment. The high internet and social media penetration across the country is driven by the deployment of 5G services, better and improved inland connectivity, availability of renewable energy and free cooling solutions, and others, making Japan an attractive market for investors. India Data Center Market - Industry Outlook & Forecast 2022-2027: India data center market size witnessed investments of USD 4.35 billion in 2021 and will witness investments of USD 10.09 billion by 2027. On the verge of becoming a digital economy, many progressive policies encourage domestic and global data center operations to make huge investments in the country. The migration of traditional service offerings to cloud-based platforms by government agencies is also one of the major driving factors of India data center market growth. The Government of India's initiative, Digital India, and increased investments by data center service providers significantly contributed to the market investment over the last two years. Due to increased data generation, there will be a demand for huge storage facilities as many small and medium-sized businesses have adopted cloud and big data analytics. GET ACCESS TO LATEST INFORMATION ON DATA CENTERS ACROSS THE GLOBE – EXPLORE THE DATA CENTER DATABASES: https://datacenter.arizton.com/ ABOUT US:????????? Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.??????? We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.???????? Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.???????? CONTACT US?????? Call: +1-312-235-2040????? Logo - https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

|