|

Semiconductor Wafer Inspection Equipment Market Size to Grow by USD 2.09 Billion | By Technology, End-user, and Geography | Growth, Trends, Covid-19 impact, and Forecasts (2021 - 2025)

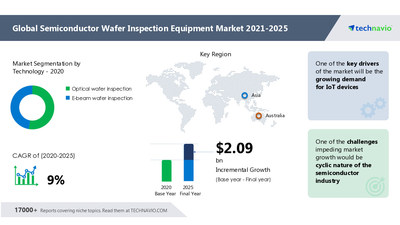

NEW YORK, June 10, 2022 /PRNewswire/ -- The Semiconductor Wafer Inspection Equipment Market is a part of the Global Semiconductor Equipment Industry. The market witnessed certain challenges due to the COVID-19 pandemic. India, China, Indonesia, and Bangladesh are some of the most affected countries. Smartphone and consumer electronics companies in India are facing production cuts and possible delays in the launch of new products due to the COVID-19 pandemic and disrupted component supplies from China. But, with the lockdowns being revoked, the growth of the market will gradually increase in the forecast period. The Semiconductor Wafer Inspection Equipment Market Share is expected to increase by USD 2.09 billion from 2020 to 2025, with an accelerated CAGR of 9%- according to the recent market study by Technavio.

Purchase Our Report to uncover new strategies of the Industry to make the most of future growth opportunities

Market Overview

- One of the key factors driving the semiconductor wafer inspection equipment market growth is the growing demand for IoT devices.

- Another key factor driving the semiconductor wafer inspection equipment market growth is the increasing focus on large diameter wafer size.

- Cyclic nature of the semiconductor industry is one of the key challenges hindering the semiconductor wafer inspection equipment market growth.

- APAC will register the highest growth rate of 78% among the other regions. Therefore, the semiconductor wafer inspection equipment market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

- The Information Technology industry is expected to have Negative impact due to the spread of COVID-19 virus.

- In the short term, the market demand will show Inferior growth due to the increase in infections and reduced economic activity.

- The semiconductor wafer inspection equipment market vendors should focus on grabbing business opportunities from the optical wafer inspection segment as it accounted for the largest market share in the base year.

Download Sample: for more additional information about the Semiconductor Wafer Inspection Equipment Market

Scope of the Report

Semiconductor Wafer Inspection Equipment Market Scope

| Report Coverage

| Details

| Page number

| 120

| Base year

| 2020

| Forecast period

| 2021-2025

| Growth momentum & CAGR

| Accelerate at a CAGR of 9%

| Market growth 2021-2025

| $ 2.09 billion

| Market structure

| Fragmented

| YoY growth (%)

| 7.57

| Regional analysis

| APAC, North America, Europe, South America, APAC, North America, Europe, and South America

| Performing market contribution

| APAC at 78%

| Key consumer countries

| China, Taiwan, Japan, Germany, and South Korea (Republic of Korea)

| Competitive landscape

| Leading companies, competitive strategies, consumer engagement scope

| Companies profiled

| Applied Materials Inc., ASML Holding NV, Camtek Ltd., Carl Zeiss AG, Hitachi High-Technologies Corp., JEOL Ltd., KLA Corp., Nikon Corp., Onto Innovation Inc., and Toray Industries Inc.

| Market Dynamics

| Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and future consumer dynamics, market condition analysis for forecast period,

| Customization preview

| If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized.

|

Didn't Find What You Were Looking For? Customize Report-

Don't miss out on the opportunity to speak to our analyst and know more insights about this market report. Our analysts can also help you customize this report according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time.

Speak to our Analyst now! to take full advantage of every opportunity using competitive analysis created just for you

Optical Wafer Inspection Held the Largest Market Share

- The semiconductor wafer inspection equipment market share growth by the optical wafer inspection will be significant during the forecast period.

- Optical wafer inspection technology is the most widely adopted wafer inspection technology in the semiconductor manufacturing industry.

- Thus, with an increase in the number of semiconductor fabs, the demand for optical wafer inspection equipment will also increase.

Buy Report Now! to gain further insights on the market contribution of various segments

APAC is Expected to Hold a Significant Share of the Market

- 78% of the market's growth will originate from APAC during the forecast period. China, Japan, and South Korea (Republic of Korea) are the key markets for semiconductor wafer inspection equipment in APAC.

- Market growth in this region will be faster than the growth of the market in other regions.

- The high concentration of foundries, semiconductor wafer manufacturers, semiconductor manufacturers, original equipment manufacturers (OEMs), and original design manufacturers (ODMs) in the region will facilitate the semiconductor wafer inspection equipment market growth in APAC over the forecast period.

Download our sample report for more key highlights on the regional market share of most of the above-mentioned countries.

Vendor Insights-

- Applied Materials Inc.

- ASML Holding NV

- Camtek Ltd.

- Carl Zeiss AG

- Hitachi High Technologies Corp.

- KLA Corp.

- Lasertec Corp.

- Nikon Corp.

- Onto Innovation Inc.

- Toray Industries Inc.

The semiconductor wafer inspection equipment market is fragmented and the vendors are deploying growth strategies such as organic and inorganic strategies to compete in the market.

Quick Buy! to find additional highlights on the vendors and their product offerings.

Recent Developments

- Applied Materials Inc.- The company offers semiconductor wafer inspection systems under the brand names APPLIED ENLIGHT optical inspection, Aera4 Mask Inspection, PROVISION 2E E beam Inspection, SEMVision G7 defect analysis and others.

- Camtek Ltd.- The company offers semiconductor wafer inspection systems under the brand names Eagle AP and EagleT AP.

- Hitachi High Technologies Corp.- The company offers semiconductor wafer inspection systems under the brand names High Speed Defect Review SEM CR6300, Wafer Surface Inspection System LS Series and Dark Field Wafer Defect Inspection System IS Series.

Download Our Sample Report to learn more about recent Developments in Semiconductor Wafer Inspection Equipment Market

Here are Some Similar Topics-

Smartphone Power Management IC Market by Price and Geography - Forecast and Analysis 2022-2026: Based on Technavio's market sizing methodology, the smartphone power management IC market size is predicted to surge to USD 3.90 billion from 2021 to 2026 at a CAGR of 5.8%. To get more exclusive research insights: Download Sample Report

DRAM Market by Application, Technology, and Geography - Forecast and Analysis 2022-2026: The DRAM market share is estimated to increase by USD 111.71 billion from 2021 to 2026, at a CAGR of 16.89%. To get more exclusive research insights: Download Sample Report

Table of Contents

1 Executive Summary

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 01: Parent market

- Exhibit 02: Market characteristics

- 2.2 Value chain analysis

- Exhibit 03: Value Chain Analysis: Semiconductor equipment

3 Market Sizing

- 3.1 Market definition

- Exhibit 04: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 05: Market segments

- 3.4 Market outlook: Forecast for 2020 - 2025

- Exhibit 06: Global - Market size and forecast 2020 - 2025 ($ million)

- Exhibit 07: Global market: Year-over-year growth 2020 - 2025 (%)

4 Five Forces Analysis

- 4.1 Five Forces Summary

- Exhibit 08: Five forces analysis 2020 & 2025

- 4.2 Bargaining power of buyers

- Exhibit 09: Bargaining power of buyers

- 4.3 Bargaining power of suppliers

- Exhibit 10: Bargaining power of suppliers

- 4.4 Threat of new entrants

- Exhibit 11: Threat of new entrants

- 4.5 Threat of substitutes

- Exhibit 12: Threat of substitutes

- 4.6 Threat of rivalry

- Exhibit 13: Threat of rivalry

- 4.7 Market condition

- Exhibit 14: Market condition - Five forces 2020

5 Market Segmentation by Technology

- 5.1 Market segments

- Exhibit 15: Technology - Market share 2020-2025 (%)

- 5.2 Comparison by Technology

- Exhibit 16: Comparison by Technology

- 5.3 Optical wafer inspection - Market size and forecast 2020-2025

- Exhibit 17: Optical wafer inspection - Market size and forecast 2020-2025 ($ million)

- Exhibit 18: Optical wafer inspection - Year-over-year growth 2020-2025 (%)

- 5.4 Electron beam wafer inspection - Market size and forecast 2020-2025

- Exhibit 19: Electron beam wafer inspection - Market size and forecast 2020-2025 ($ million)

- Exhibit 20: Electron beam wafer inspection - Year-over-year growth 2020-2025 (%)

- 5.5 Market opportunity by Technology

- Exhibit 21: Market opportunity by Technology

6 Market Segmentation by End-user

- 6.2 Comparison by End-user

- 6.3 Foundries - Market size and forecast 2020-2025

- Exhibit 24: Foundries - Market size and forecast 2020-2025 ($ million)

- Exhibit 25: Foundries - Year-over-year growth 2020-2025 (%)

- 6.4 IDMs - Market size and forecast 2020-2025

- Exhibit 26: IDMs - Market size and forecast 2020-2025 ($ million)

- Exhibit 27: IDMs - Year-over-year growth 2020-2025 (%)

- 6.5 Market opportunity by End-user

- Exhibit 28: Market opportunity by End-user

7 Customer landscape

8 Geographic Landscape

- 8.1 Geographic segmentation

- Exhibit 30: Market share by geography 2020-2025 (%)

- 8.2 Geographic comparison

- Exhibit 31: Geographic comparison

- 8.3 APAC - Market size and forecast 2020-2025

- Exhibit 32: APAC - Market size and forecast 2020-2025 ($ million)

- Exhibit 33: APAC - Year-over-year growth 2020-2025 (%)

- 8.4 North America - Market size and forecast 2020-2025

- Exhibit 34: North America - Market size and forecast 2020-2025 ($ million)

- Exhibit 35: North America - Year-over-year growth 2020-2025 (%)

- 8.5 Europe - Market size and forecast 2020-2025

- Exhibit 36: Europe - Market size and forecast 2020-2025 ($ million)

- Exhibit 37: Europe - Year-over-year growth 2020-2025 (%)

- 8.6 South America - Market size and forecast 2020-2025

- Exhibit 38: South America - Market size and forecast 2020-2025 ($ million)

- Exhibit 39: South America - Year-over-year growth 2020-2025 (%)

- 8.7 MEA - Market size and forecast 2020-2025

- Exhibit 40: MEA - Market size and forecast 2020-2025 ($ million)

- Exhibit 41: MEA - Year-over-year growth 2020-2025 (%)

- 8.8 Key leading countries

- Exhibit 42: Key leading countries

- 8.9 Market opportunity by geography

- Exhibit 43: Market opportunity by geography ($ million)

9 Drivers, Challenges, and Trends

- 9.2 Market challenges

- Exhibit 44: Impact of drivers and challenges

10 Vendor Landscape

- 10.2 Vendor landscape

- Exhibit 45: Vendor landscape

- 10.3 Landscape disruption

- Exhibit 46: Landscape disruption

- Exhibit 47: Industry risks

11 Vendor Analysis

- 11.1 Vendors covered

- Exhibit 48: Vendors covered

- 11.2 Market positioning of vendors

- Exhibit 49: Market positioning of vendors

- 11.3 Applied Materials Inc.

- Exhibit 50: Applied Materials Inc. - Overview

- Exhibit 51: Applied Materials Inc. - Business segments

- Exhibit 52: Applied Materials Inc. – Key news

- Exhibit 53: Applied Materials Inc. - Key offerings

- Exhibit 54: Applied Materials Inc. - Segment focus

- 11.4 ASML Holding NV

- Exhibit 55: ASML Holding NV - Overview

- Exhibit 56: ASML Holding NV - Business segments

- Exhibit 57: ASML Holding NV – Key news

- Exhibit 58: ASML Holding NV - Key offerings

- 11.5 Camtek Ltd.

- Exhibit 59: Camtek Ltd. - Overview

- Exhibit 60: Camtek Ltd. - Business segments

- Exhibit 61: Camtek Ltd. - Key offerings

- 11.6 Carl Zeiss AG

- Exhibit 62: Carl Zeiss AG - Overview

- Exhibit 63: Carl Zeiss AG - Product and service

- Exhibit 64: Carl Zeiss AG - Key offerings

- 11.7 Hitachi High Technologies Corp.

- Exhibit 65: Hitachi High Technologies Corp. - Overview

- Exhibit 66: Hitachi High Technologies Corp. - Business segments

- Exhibit 67: Hitachi High Technologies Corp. – Key news

- Exhibit 68: Hitachi High Technologies Corp. - Key offerings

- Exhibit 69: Hitachi High Technologies Corp. - Segment focus

- 11.8 KLA Corp.

- Exhibit 70: KLA Corp. - Overview

- Exhibit 71: KLA Corp. - Business segments

- Exhibit 72: KLA Corp. - Key offerings

- Exhibit 73: KLA Corp. - Segment focus

- 11.9 Lasertec Corp.

- Exhibit 74: Lasertec Corp. - Overview

- Exhibit 75: Lasertec Corp. - Business segments

- Exhibit 76: Lasertec Corp. - Key offerings

- 11.10 Nikon Corp.

- Exhibit 77: Nikon Corp. - Overview

- Exhibit 78: Nikon Corp. - Business segments

- Exhibit 79: Nikon Corp. - Key offerings

- Exhibit 80: Nikon Corp. - Segment focus

- 11.11 Onto Innovation Inc.

- Exhibit 81: Onto Innovation Inc. - Overview

- Exhibit 82: Onto Innovation Inc. - Business segments

- Exhibit 83: Onto Innovation Inc. – Key news

- Exhibit 84: Onto Innovation Inc. - Key offerings

- 11.12 Toray Industries Inc.

- Exhibit 85: Toray Industries Inc. - Overview

- Exhibit 86: Toray Industries Inc. - Business segments

- Exhibit 87: Toray Industries Inc. - Key offerings

- Exhibit 88: Toray Industries Inc. - Segment focus

12 Appendix

- 12.2 Currency conversion rates for US$

- Exhibit 89: Currency conversion rates for US$

- 12.3 Research methodology

- Exhibit 90: Research Methodology

- Exhibit 91: Validation techniques employed for market sizing

- Exhibit 92: Information sources

- 12.4 List of abbreviations

- Exhibit 93: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/semiconductor-wafer-inspection-equipment-market-size-to-grow-by-usd-2-09-billion--by-technology-end-user-and-geography--growth-trends-covid-19-impact-and-forecasts-2021---2025-301564805.html View original content to download multimedia:https://www.prnewswire.com/news-releases/semiconductor-wafer-inspection-equipment-market-size-to-grow-by-usd-2-09-billion--by-technology-end-user-and-geography--growth-trends-covid-19-impact-and-forecasts-2021---2025-301564805.html

SOURCE Technavio

[ Back To TMCnet.com's Homepage ]

|