TMCnet News

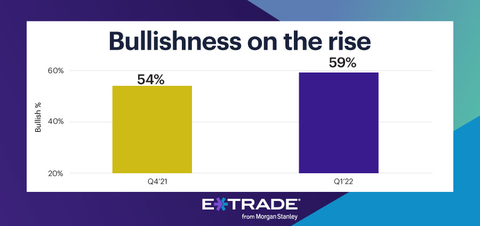

E*TRADE Study Reveals Bullishness Returns Despite Inflation and COVID ConcernsE*TRADE Securities LLC today announced results from the most recent wave of StreetWise, the E*TRADE quarterly tracking study of experienced investors. Results include: This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220112005741/en/

(Graphic: Business Wire)

"There's no question that it's been pretty hard to rattle retail investors since the onset of the pandemic," said Mike Loewengart, Managing Director of Investment Strategy at E*TRADE. "But with the Fed sounding a more hawkish tone, tightening measures are on the horizon. That's not to say there isn't room for growth, but investors need to stay diversified and committed to their long-term goals, if and when the market takes a turn. It's important to keep in mind that while the Fed is shifting gears, ultimately that translates into a vote of confidence for the economy." The survey explored investor views on sector opportunities for the first quarter of 2022:

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. To learn more about E*TRADE's trading and investing platforms and tools, visit etrade.com. For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE. About the Survey This wave of the survey was conducted from January 3 to January 11 of 2022 among an online US sample of 901 self-directed active investors who manage at least $10,000 in an online brokerage account. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands. About E*TRADE from Morgan Stanley and Important Notices E*TRADE from Morgan Stanley provides financial services to retail customers. Securities products and services offered by E*TRADE Securities LLC, Member SIPC. Investment advisory services offered by E*TRADE Capital Management, LLC, a Registered Investment Adviser. Commodity futures and options on futures products and services offered by E*TRADE Futures LLC, Member NFA. Banking products and services are offered by Morgan Stanley Private Bank, National Association, Member FDIC. All separate but affiliated subsidiaries of Morgan Stanley. More information is available at www.etrade.com. The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results. E*TRADE from Morgan Stanley, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE from Morgan Stanley. ETFC-G ETFC © 2022 E*TRADE from Morgan Stanley. All rights reserved. E*TRADE engages Dynata to program, field, and tabulate the study. Dynata provides digital research data and has locations in the Americas, Europe, the Middle East and Asia-Pacific. For more information, please go to www.dynata.com. Referenced Data

View source version on businesswire.com: https://www.businesswire.com/news/home/20220112005741/en/ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||