TMCnet News

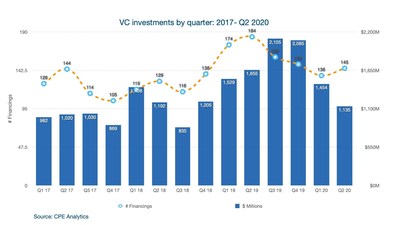

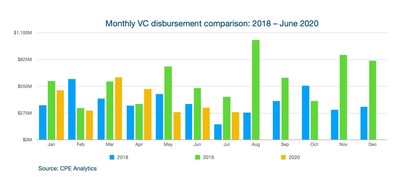

Canadian VC reaches $2.59B in H1 2020, two consecutive quarterly drops from Q3/Q4 2019TORONTO, Sept. 8, 2020 /CNW/ - Canadian venture capital investment activities reached 281 financings totaling $2.59 billion during the first half (H1) of 2020 according to the Canadian Venture Capital Report released today by CPE Analytics, the data analytics division of CPE Media Inc. (All amounts in Canadian dollars unless otherwise stated) The first half activities were down 22% and 19% respectively from the same period in 2019, accompanied by two sharp consecutive quarterly drops from Q3 and Q4, 2019. COVID-19 impact on Canadian VC in H1 2020 With the exception of steep drops in disbursements in May and June, 2020 so far is performing fairly against 2019 and 2018 (please note that the disbursement figure for July 2020 is incomplete and it is still being compiled). The impact of COVID-19 will likely continue to stretch out in the second half. CPE Analytics strives to accurately report VC activities and deal closing time. It should be noted that several large deals that were announced in Q2 and reported by some data providers as Q2 deals were in fact closed in Q1 2020 or Q4 2019. The measurements of COVID-19 impact by those providers are just as reliable as they dated the VC deals. US Investor share of H1 2020 VC funding drops below 40% US investors play important role in supporting Canadian startup companies. For the past three years, the US investor shares have always been above 40%: 46% (2017), 41% (2018) and 46% (2019). It is with concern that the US funding share in H1 2020 dropped to 30% of total disbursements. "The data for H1, 2020 indicate that venture capital investing has been significantly affected by the eruption of COVID-19, much like the broader economy. The data reflect some particularities of venture capital too as this part of the financial services industry has long relied on face-to-face meetings with startup and early stage firm entrepreneurs prior to making investment decisions. Of note is the decline in the percentage contribution of US-led investment across the board, but acutely in certain parts of the country, notably Québec," commented Richard Rémillard, President of Rémillard Consulting Group (RCG). H1 2020 - Venture Capital disbursements - where the funding went

H1 2020 - Venture Capital funding sources - where the funding came from

H1 2020 - USA and foreign investment breakdowns

H1 2020 - Fundraising by Canadian VC firms

H1 2020 - Active VC law firms

The full report can be downloaded from financings.ca website: https://www.financings.ca/reports/ About Rémillard Consulting Group (RCG) Rémillard Consulting Group (RCG) is a unique, Ottawa-based, bilingual consulting firm specializing in providing private sector, government & trade association clients with creative, research-grounded solutions to business issues and public policies involving the Canadian financial services industry. For more information: https://remillardconsulting.com/. About CPE Analytics CPE Analytics is a provider of comprehensive, unbiased and verified information on Canadian venture capital industry, and Canada's only provider on all Canadian private and public financing activities. Backed by over 27 years' private capital research experience, we are Canada's only data provider that actively tracks and provides analysis on where the Canadian venture capital funding came from - by investor types and by provinces, countries or regions. We provide this essential information for truly evidence-based policy analysis and decision making, and for the true understanding of the Canadian venture capital ecosystem. INFORMATION YOU CAN USE. CPE Analytics is the data analytics division of CPE Media Inc. More Info: https://cpeanalytics.ca, https://financings.ca, https://cpemedia.ca/ SOURCE CPE Media Inc.

|