TMCnet News

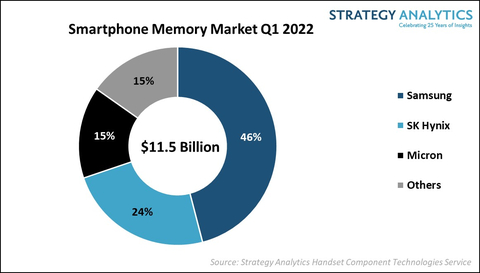

Strategy Analytics: Samsung, SK Hynix and Micron Dominate the Smartphone Memory Market in Q1 2022The global smartphone memory market clocked a total revenue of $11.5 billion in Q1 2022, according to the Strategy Analytics Handset Component Technologies service report. "Smartphone Memory Market Share Q1 2022: Samsung Takes 46 Percent Share." This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220706005055/en/

Smartphone Memory Market Q1 2022; Source: Strategy Analytics' Handset Component Technologies Service The report finds that Samsung managed the top spot in the smartphone memory market (DRAM & NAND) followed by SK Hynix and Micron in Q1 2022. The combined revenue share of the top 3 vendors reached 85 percent in the global smartphone memory market in the quarter. NAND Market The overall NAND flash market revenue for smartphones witnessed a revenue growth of 7 percent year-over-year driven by the shipment of high-capacity UFS NAND flash chips. Samsung managed a revenue share of 39 percent followed by SK Hynix and Kioxia each having 23 percent and 20 percent respectively in the smartphone NAND market in Q1 2022. In terms of specifications, 128GB NAND capacity share has now reached 45 percent owing to the expansion of UFS 3.1 and UFS 2.2 NAND productsin smartphones. DRAM Market The smartphone DRAM memory chip segment revenues suffered a decline of 7 percent as OEM demand weakened due to seasonality and disruption in the customer supply chain. Samsung led in terms of market share, capturing a revenue share of 52 percent followed by SK Hynix with 25 percent and Micron with 22 percent in the smartphone DRAM market in Q1 2022. LPDDR4X products dominate share while DRAM products with LPDDR5 specifications continue to witness demand from customers. Jeffrey Mathews, Senior Analyst at Strategy Analytics commented, "The Smartphone Memory market experienced a modest decline annually owing to the seasonal slowdown in the end-market combined with the pandemic-induced disruption in customer supply chains in Q1 2022. However, 5G momentum drove the shipment of memory products with higher specifications, leading to an increase in NAND and DRAM content in mid and high-tier smartphones. Samsung Memory, SK Hynix and Micron all faced a drop in demand and were affected by the weakness in the smartphone market." Stephen Entwistle, Vice President of the Strategic Technologies Practice at Strategy Analytics added, "Memory vendors continue to see increased opportunities in the growing 5G smartphone market with the expansion of UFS-based LPDDR5 Multi-Chip Package (uMCP5) memory products and the introduction of LPDDR5X DRAM products during the year. We note the weak end-market demand and challenging macroeconomic climate would impact the growth prospects of the smartphone memory market in 2022." Source: Strategy Analytics, Inc. #SA_Components About Strategy Analytics Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com. For more information about Strategy Analytics Service Name: Handset Component Technologies

View source version on businesswire.com: https://www.businesswire.com/news/home/20220706005055/en/ |