TMCnet News

Satisfaction Rises among Clients Using Financial Advisors, but Lack of Loyalty among More Affluent Millennials Sets Stage for Future Challenges, J.D. Power FindsA rising tide lifts all boats, and a strong stock market makes investors feel good about their financial advisors, but what happens when the tide recedes? That's the central question explored in the J.D. Power 2024 U.S. Full-Service Investor Satisfaction Study,SM which finds a significant 8-point (on a 1,000-point scale) year-over-year increase in investor satisfaction. However, the study also finds pockets of weakness, notably among the rising ranks of affluent Millennial1 investors, with 36% of them saying they "probably will" or "definitely will" switch firms in the next year. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240321470966/en/

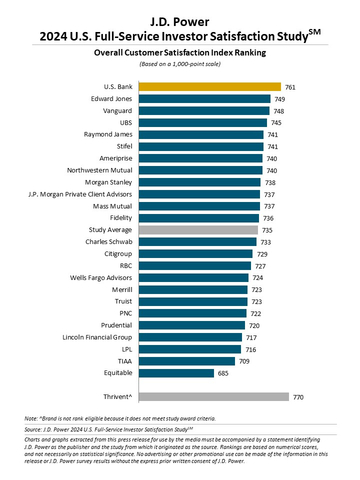

2024 U.S. Full-Service Investor Satisfaction Study (Graphic: Business Wire) "It is conventional wisdom that investor satisfaction tracks closely with stock market performance, but for advisors who want to build long-term, sustainable relationships that can weather good markets and bad, they will need to build a deeper level of engagement with clients," said Craig Martin, executive managing director and global head of wealth and lending intelligence at J.D. Power. "This is especially true among the younger segment of investors who show lower levels of client loyalty than investors in other generational groups. Advisors will need to adjust their approach to meaningfully connect with younger investors or risk a major outflow of assets in coming years." Following are some key findings of the 2024 study:

U.S. Bank ranks highest in overall investor satisfaction with a score of 761. Edward Jones (749) ranks second and Vanguard (748) ranks third. The U.S. Full-Service Investor Satisfaction Study, now in its 22nd year, measures overall investor satisfaction with full-service investment firms in seven dimensions (in order of importance): trust; people; products and services; value for fees; ability to manage wealth how and when I want; problem resolution; and digital channels. The 2024 study is based on responses from 9,951 investors who work directly with a dedicated financial advisor or team of advisors. The study was fielded from January 2023 through January 2024. For more information about the U.S. Full-Service Investor Satisfaction Study, visit https://www.jdpower.com/business/wealth-management-platform. See the online press release at http://www.jdpower.com/pr-id/2024024. About J.D. Power J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies. J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com. About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240321470966/en/ |