TMCnet News

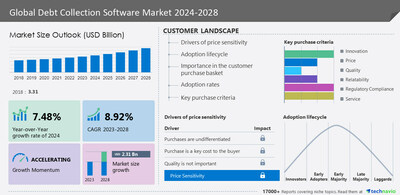

Debt Collection Software Market, 31% of Market Growth is Expected in APAC by 2028 - TechnavioNEW YORK, Feb. 2, 2024 /PRNewswire/ -- The Debt Collection Software Market is estimated to grow at a CAGR of 8.92% between 2023 and 2028. The market size is forecast to increase by USD 2.31 billion. APAC is estimated to contribute 31% to the growth of the global market during the forecast period. North America is another region that presents substantial growth prospects for companies. This growth is driven by factors like robust IT infrastructure and a strong presence of debt collection agents and accounts receivable management firms in the US and Canada. Across various industries in North America, organizations are enhancing their operations to improve customer satisfaction and gain a competitive edge globally. Additionally, the highest adoption of debt collection software is seen in North American countries like the US and Canada, attributed to the growth of the banking and healthcare sectors in the region. Discover some insights on the market size historic period (2018 to 2022) and Forecast 2024-2028 before buying the full report -Request a Free sample report Company Landscape - The debt collection software market is fragmented, with the presence of several global as well as regional companies. A few prominent companies that offer debt collection software in the market are AgreeYa Solutions Inc., Analog Legalhub Technology Solutions Pvt. Ltd., CDS Software, Chetu Inc., Comtech Systems Inc., Comtronic Systems LLC, DAKCS Software Systems Inc., Debt Pay Inc., DebtCol Software Pty. Ltd., Debtrak, Experian Plc, ezyCollect Pty. Ltd., Fair Isaac Corp., Fidelity National Information Services Inc., Gaviti Akyl Ltd., Indigo Cloud Ltd., MarketXpander Services Pvt. Ltd., Nestack Technologies Pvt. Ltd., PDCflow, PrimeSoft Solutions Inc., Quantrax Corp. Inc., Radixweb, receeve GmbH, Sila Inc., Totality Software Inc., A4dable Software, Ameyo Pvt Ltd., DBA PaySimple Inc., and Simplicity Collection Software and others.

Technavio has segmented the market based on Deployment (On-premises and Cloud-based), Industry Application (Small and medium enterprises and Large enterprises), and Geography (North America, Europ, APAC, South America, and Middle East and Africa).

For insights on global, regional, and country-level parameters with growth opportunities from 2017 to 2027 - Download a Free Sample Report The rise in non-performing loans (NPLs) is a key factor driving growth. The global debt collection software market is growing due to the increasing number of non-performing loans (NPLs) across sectors like utilities and healthcare. Economic disruptions like the 2008 financial crisis and the COVID-19 pandemic have led to more delayed or defaulted payments. Banks and collection agencies are investing in advanced software to address this challenge, driving innovation in the industry.

Driver, Trend & Challenges are the factor of dynamics that states about consequences & sustainability of the businesses, find some insights from a free sample report! Debt Collection Software: Benefits Debt collection software offers numerous benefits for managing accounts receivable and optimizing collections. It streamlines debt recovery processes for collection agencies and financial institutions, providing efficient debt consolidation and recovery solutions. These tools automate collections, payment processing, and workflow, enhancing efficiency while ensuring compliance with regulations. Debt collection software also includes customer communication tools for effective outreach and negotiation, along with skip-tracing capabilities for locating debtors. Advanced features like debt settlement platforms and recovery analytics improve debt portfolio management while reporting and analytics tools offer insights for informed decision-making and collection strategy refinement. Overall, debt collection software is essential for streamlining operations and improving the effectiveness of debt recovery efforts. What are the key data covered in this Debt Collection Software Market report?

Technavio's SUBSCRIPTION platform Related Reports The Audit Software Market size is projected to increase by USD 1,177.2 million, at a CAGR of 13.89% between 2023 and 2028. The SMB software market is estimated to grow by USD 57.76 billion at a CAGR of 7.41% between 2022 and 2027. ToC: Executive Summary Market Landscape Market Sizing Historic Sizes Five Forces Analysis Segmentation by Deployment Segmentation by Industry Application Segmentation by Geography Customer Landscape Geographic Landscape Drivers, Challenges, & Trends Company Landscape Company Analysis Appendix About US Contact

SOURCE Technavio

|