| [January 10, 2018] |

|

American Express Leads Financial Services Brands in Social Media Analysis Report; Bitcoin is in Close Pursuit

NetBase,

a global leader in enterprise social analytics, released its 2018

Financial Services Report today. The analysis focused on 55 brands

across the following categories: Banking, Credit Cards, Investment

Banking, Payment Services, Insurance, Internet Lending and

Cryptocurrency. The report uses NetBase themes to look beyond the sheer

volume of conversations, and dive into the emotions and sentiment of

over 142 million social media mentions.

This press release features multimedia. View the full release here:

http://www.businesswire.com/news/home/20180110005399/en/

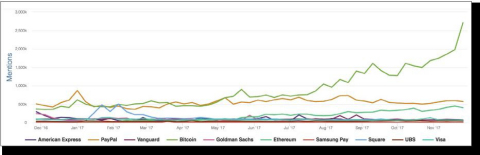

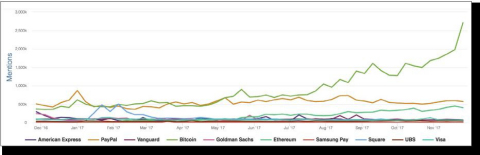

Top 10 Brand Mention Volume 2017 (Photo: Business Wire)

The top ten brands were American Express (News - Alert), PayPal, Vanguard, Bitcoin,

Goldman Sachs, Ethereum, Samsung Pay, Square, UBS and Visa.

Looking at category trends, Cryptocurrency was responsible for 40

percent of the conversation volume, payment services held 26 percent. It

is interesting to note the meteoric rise of cryptocurrencies in 2017, as

Bitcoin went from average conversation volume to extremely high

conversation volume late last year.

Key findings:

-

Bitcoin word association: Whether positive or negative, the

word most associated with bitcoin is 'Risk' by a large margin. Bitcoin

(#4) users are concerned and excited about the risks of investing in

the currency. Money, Investment and Buy were other commonly associated

words.

-

People Love Travel Points: American Express (#1) and Visa (#10)

were in the top 10 for all financial brands thanks to a boost in

conversation around point perks. Ameican Express users discuss travel

nearly 4x as much as the general twitter audience.

-

"I don't have cash" is no Longer an Excuse: Payment services

are more than companies, they are verbs. Writing IOUs to split dinner

is a thing of the past thanks to PayPal (News - Alert) (#2), Square (#8) and Venmo

(#24). There were over 1.5 million mentions between the three stemming

from people's conversations about friends and eating.

-

Investing? There's an App for that: While the traditional

brands like Vanguard (#3) hold the spotlight now, new apps are

starting to challenge their position. New brands like Robinhood (#19),

Wealthfront (#21), and Stash (#48) have been storming up to social

rankings to unseat the traditional retirement savings options. While

they may not have the numbers of mentions, sentiment is higher for

these disrupters. Fintech companies also have an edge with younger

investors, enjoying 5 percent more conversation with those 25-44 than

traditional companies like Schwab and Fidelity.

-

Keep it Consistent: While insurance brands only represented 3

percent of the total conversation volume measured in this report, they

comprised the third most passionate category. Insurance companies

found strong responses to their sports sponsorships and commercials,

which consistently drive conversation for insurance brands.

-

Money Talks: Like insurance, internet lending is not something

that consumers generally talk about online. Consumers are

listening-and even though there is low conversation volume overall,

customers are still sharing their experiences and stories on social

media. Interest is a common theme, and generally, consumers see

interest rates and fees from these online providers as positive.

"Financial services brands have special relationships with customers,

people need to trust these brands with their money, their hopes and

their dreams" said Paige Leidig, chief marketing officer at NetBase.

"Our data shows consumers are passionate about learning and sharing

financial advice online. Brands that are willing to meet and engage with

their customers are getting ahead."

Read the full NetBase 2018 Financial Services Industry Report here.

Methodology

Indexing and social ranking is an average measure of actual position for

each metric, with the largest, most positive, or most passionate brands

ranking first. Our analysis of brand performance, which ran Dec. 1,

2016, to Dec. 1, 2017, looked at volume of conversation, reach, net

sentiment and brand passion as measured and analyzed through the NetBase

platform.

NetBase used the following metrics for the report:

-

Volume of conversation - Overall volume of conversation.

-

Reach - Impressions from original tweets posted by a brand and any

replies to or retweets of the brand. This is a measure of "owned"

impressions.

-

Awareness - Impressions from all tweets that mention a brand,

excluding those classified as owned tweets. This is a measure of

"earned" impressions.

-

Passion Intensity - Indicating how strongly consumers feel about a

brand on a scale of 0-100.

-

Net Sentiment - Measuring the overall direction of consumers' feelings

toward a brand on a scale of -100 to +100.

-

Brand Passion Index (BPI) - Weighted average of Passion Intensity and

Net Sentiment to represent overall favorability.

About NetBase

NetBase is the award-winning social analytics

platform that global companies use to run brands, build businesses and

connect with consumers every second. Its platform processes millions of

social media posts daily for actionable business insights for marketing,

research, customer service, sales, PR and product innovation. NetBase is

a trusted partner to American Airlines, Arby's, Coca-Cola,

Ogilvy, T-Mobile (News - Alert), Universal Music Group, Walmart

and YUM! Brands. Learn more at www.netbase.com

or @NetBase.

View source version on businesswire.com: http://www.businesswire.com/news/home/20180110005399/en/

[ Back To TMCnet.com's Homepage ]

|