We’ve all likely seen the Gartner (News ![]() - Alert) hype cycle for emerging technologies curve. I remember many, many years ago when I first saw that curve. I don’t even remember the context, but I remember it had the Peak of Inflated Expectations, and then the dip down, and then the path to nirvana. That curve stays relevant over time because it is so true. NFV is currently in the Peak of Inflated Expectation area, or possibly just beyond, and starting its journey to the Trough of Disillusionment.

- Alert) hype cycle for emerging technologies curve. I remember many, many years ago when I first saw that curve. I don’t even remember the context, but I remember it had the Peak of Inflated Expectations, and then the dip down, and then the path to nirvana. That curve stays relevant over time because it is so true. NFV is currently in the Peak of Inflated Expectation area, or possibly just beyond, and starting its journey to the Trough of Disillusionment.

No matter where NFV is on that curve, it will change the telecom industry. I just don’t believe it’s right around the corner and will change the industry by the end of 2016. Like any new technology, there are challenges that need to be addressed head on and tackled. And the industry will tackle them, and overcome them before all of this becomes a reality. I’ll address some of these challenges from a perspective of a vendor supplying NFVs. I’m sure carriers will have additional challenges they’ll face.

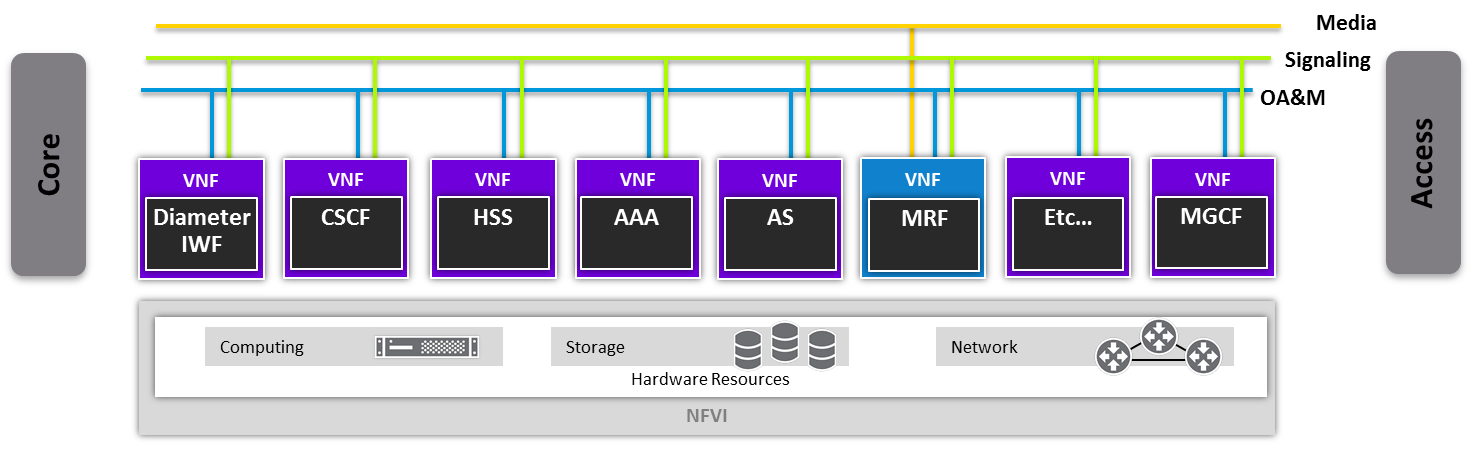

First and foremost, there are many vendors that have telecom infrastructure products in the form of software. But just because these products are software does not mean that they all interoperate together into one big network function. In the new paradigm, a network diagram would look something like the graphic.

There are familiar elements, such as a media resource function, an application server, and a signaling interworking function. But in the new network architecture, they are all pieces of software running in cloud environments connected, and controlled, and interworking seamlessly. While the picture looks nice and all buttoned up, the reality is that multiple vendors will need to interwork together to form an NFV, at lower levels than previously defined. For instance, in any carrier network there are likely to be hardware boxes from a wide variety of vendors, all talking to each other. Standards play a vital role here. But the amount of interaction is limited compared to a NFV model. In an NFV model, where virtual network functions may be best of breed, the amount of inter-vendor interaction is likely to be many, many more times complex than exists today.

So, how will all these vendors interact? This is all to be done via a management and orchestration, or MANO, layer. Yes, there is MANO software entering the fray from established telecom vendors such as Oracle, HP, and Ericsson, but also from new startups such as Cyan. Dialogic (News - Alert) is working with many of the major players in this area, but the real leaders may yet still emerge. Until that happens, this area will be somewhat confusing and will slow things down. That’s normal with any new technology. Open Platform for NFV, or OPNFV, should play a vital role here.

From a signaling perspective, the Diameter signaling controller could play a vital role in signaling orchestration. All signaling would be going through the DSC anyway, so enhancing the DSC to play a more central signaling orchestration and security role could provide value. As NFV starts to take hold, software-based DSCs are in a central position in the network regarding routing and protocol interworking. The DSC could therefore become a vital element in policy orchestration for NFV in general, just because it’s central to the Diameter flows that touch all the different VFNs. If there were server failures, application failures, or VNF failures, the DSC could be in the middle of that and start to orchestrate the signaling.

Another challenge will be scaling and performance of the NFV. Moving from specialized hardware that is optimized for a network function to commercial off-the-shelf servers running the software, and expecting the same performance, will take some effort. Software-based load balancers are required to get to the performance levels of specialized hardware. Many vendors will take time to address performance, and it will be difficult for some. Some will make it forward, but new startups will likely also make their mark here. This entire change in paradigm will also likely prove to be a challenge and slow down NFV. However, because service providers want to deploy NFV for the reasons the industry has been talking about – capex reduction, opex reduction, and new service delivery – and they want to deploy it as fast as possible, the vendors will move fast to position themselves.

The move to NFV is upon us. There will be vendor winners and losers from this transition. But it’s not going to happen overnight, and there is much work to be done in the industry to enable this transition.

Jim Machi is senior vice president of product management and marketing at Dialogic Inc. (www.dialogic.com).

Jim Machi is vice president of product management at Dialogic Inc. (www.dialogic.com).

Edited by Kyle Piscioniere