There seems to be little to no argument left around the need for fiber-based networking around the world. Even the mobile network operators prefer fiber for their wireless backhaul. Beyond the enlightenment of the need, though, there still seems to be some lingering haze around the state of dark fiber availability throughout the United States.

To be clear, not all fiber is, or was, created equal here in this country. Much of the fiber outside of a few major metros and fewer lower-tier cities is carrier-owned and therefore not readily available for lease, or IRU on any terms let alone reasonable ones. This is just a matter of course for carriers that do not wish to enable their competitors with the same benefit of control of fiber from their own inventory. Therein lies a conundrum.

Aside from an outright acquisition of a fiber-based network operator when leasing or buying dark fiber pairs, the only alternative is to build a new fiber route. The cost to build a new fiber route where one does not exist (to a tower, town, data center, office building, school, etc.) includes procuring rights of way that are typically costly, as are the time and materials expense of building a fiber cable and, or conduit/duct for a buried route and the placing of it. For long-haul routes, there is also the time and expense of building conditioned space for housing optical amplification equipment.

This effort and expense logically compels network planners to over-size the fiber cable since labor and rights of way are essentially fixed and the incremental cost of fiber pairs in a cable is not that much. The scenario does not make sense to the finance department though, as they would prefer just to lease or purchase only the amount of fiber the network needs for its own internal purposes and not have to build it from scratch. They also do not ultimately want to overbuild a fiber cable and be left with excess fiber that they are not willing to sell to competitors anyway. Therein lies another conundrum.

In addition to these conundrums there have been several years of dark fiber network mergers and acquisitions, consolidation and sales of fiber inventory that have now left the U.S in a state of fiber exhaust in many places in the country. In other places there is not any dark fiber at all as it has just simply not been built there yet, but now there is a need such as at a wireless tower. Add to that the fact that network operators do not wish to spend their own capital to build new. They would much prefer someone else to do it and they then just lease dark fiber from that provider. As a result, we have the great fiber standoff, or fiber gap, that we now face.

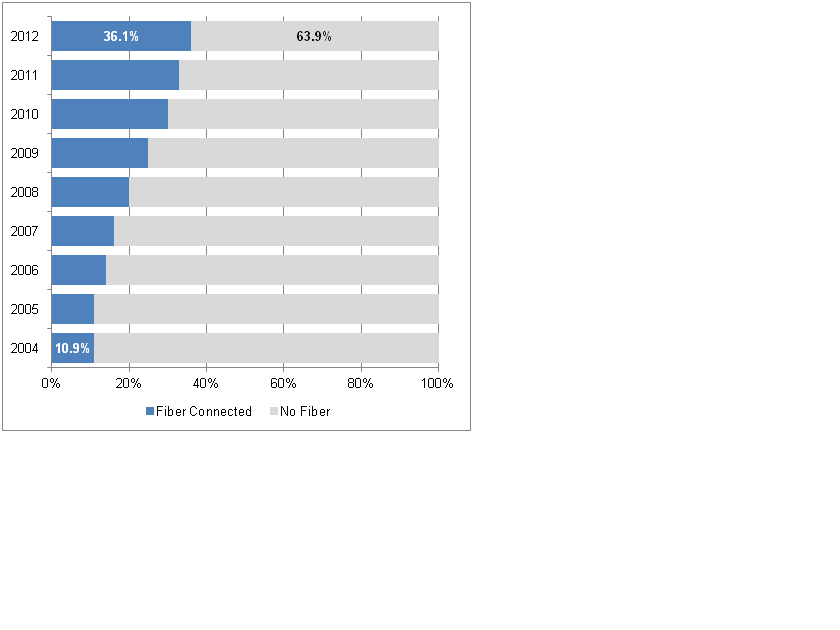

The U.S. lags behind most developed countries as far as Internet speed is concerned. Optical fiber facilities currently reach only 36.1 percent of U.S. commercial buildings, leaving the remaining 63.9 percent in the fiber gap.

Fiber Availability - % of Buildings with 20+ Employees

Source (News - Alert): Vertical Systems Group

Looking at the data from Vertical Systems Group it is evident that the fiber gap for commercial office buildings has closed a mere 25.2 percent since 2004, when the penetration rate was 10.9 percent, representing a compound annual growth rate of only 16.1 percent. At that rate, it will take another 18 years for the U.S. to reach 95 percent-plus fiber penetration to commercial office buildings.

“Direct fiber is clearly the preferred access technology for carrier Ethernet services, as well as for higher speed connectivity to IP VPNs, cloud-based applications and the Internet. Enterprise customers prefer direct fiber due to the benefits of scalability to multi-gigabit speeds plus lower bandwidth costs as compared to other access options,” says Rosemary Cochran of Vertical Systems Group.

The percentage of fiber penetration to wireless towers and tower sites is about the same in the U.S. with around 30 percent of the 300,000 towers and tower sites (antenna attachments to structures other than a tower, i.e. a building) in the U.S. having fiber access and the remainder having no fiber at all. Without an investment in new dark fiber the U.S. will simply not be able to grow at a rate to keep pace with the rest of the developed word. Given the statistics the need for increased fiber availability is clear and the only lingering haze is the fog of ignorance that blocks the view of those that still don’t get it.

Hunter Newby (News - Alert) is CEO of Allied Fiber (www.alliedfiber.com).

Edited by Stefania Viscusi