While the telephone used to be a single-purpose and uniform device, with a relatively simple network to which it was connected and operated by a single entity, it no longer has the sole purpose of delivering voice connectivity. With the proliferation of IP, the demand for unified communications, and given the rise of the ‘smartphone,’ the industry has founded the premise that the telephone network is now a platform that can support various third-party applications; which has left communication service providers to rethink how they use communications.

There’s no doubt that while IP communications is still very much in its evolutionary days, it has disrupted the very way that carriers and service providers offer up and deliver voice and data communications and network services. The speed at which the industry is changing has left them continually seeking ways to unify and integrate communication offerings through an increasing variety of devices and applications; and lately, especially those connected via the cloud. Providers are still bound by the legacy workflows of the PSTN, forced to pull through and manage disparate applications at the front end, while the ambition of unified communications systems still hope to ease the difficulty in application sourcing and fulfillment for end-users.

All the while, change beyond its means has only compounded the rise of CSPs within the industry. It has opened the door to an even larger number, each with their own business and service models, network infrastructure, and wholesale service providers from which to buy and sell services, and push products out to – all intent on rivaling to reach the crest of this IP wave, and contain mounting end-user demands for better and faster communication applications, features, and devices.

However, the ability to leverage IP and pull together a unified offering for sale or resale is still tougher than ever. Whether it’s a facilities-based provider that’s supplying wholesale voice or an Internet Telephony (News - Alert) Services Provider (ITSP) or an application provider that needs to buy on- or off-net services quickly and just-in-time, the process is like putting together a jigsaw puzzle.

“Imagine trying to bring together numerous mismatched pieces strewn across a table into a unified image; similarly, to bring together a unified communications offering, some pieces may belong to one network while numerous others are scattered across other provider networks, explains David Walsh, CEO of Shango (News - Alert). “The task of sorting, matching and joining them together seamlessly to create that product requires some ubiquitous manner of orchestration—that’s the underlying challenge facing providers day-to-day, is coming up with one; and without strategies like utilizing APIs to instill some automation, the orchestration issue is only compounded,” he asserts.

To leverage provider network services today comes with the reality that bringing a product to market could take months, given that the pieces reside on different networks. Plus, the ability to orchestrate disparate components on both the buy side and the sell side to bring a product to market is a very complex and tedious process, and taxing on operations when you bring in cost, resources, and even API development into the mix.

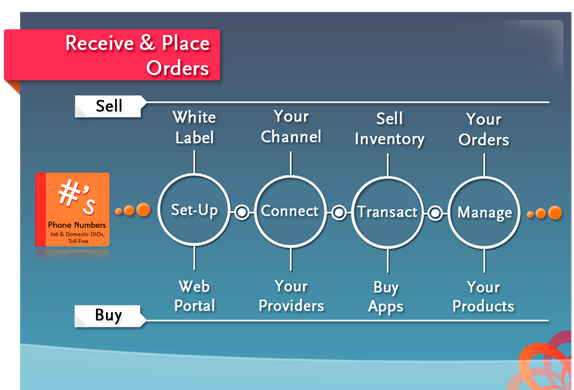

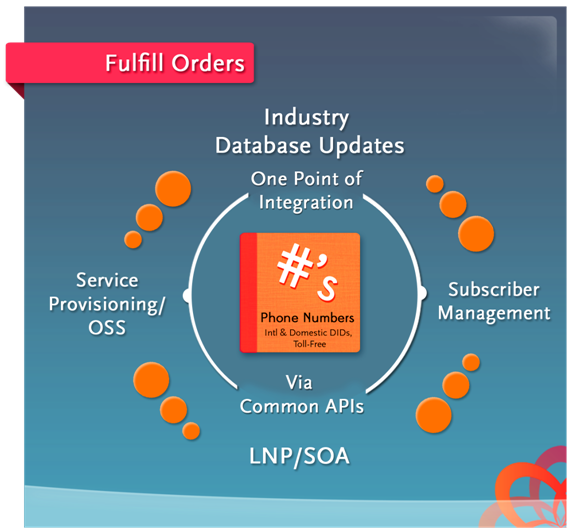

The Shango marketplace facilitates the order and fulfillment process of any IP service or application from any provider. Through its common API, Shango has created an open, common platform for CSPs, which eliminates the need for manual swivel chair processes when putting together an IP-based offering. In fact, Shango enables carriers, operators and their service provider customers to pull through best-of breed, third-party applications, manage and fulfill those orders, and present applications out to customers in a seamless way.

“The marketplace is providing a common meeting place for buyers and sellers of wholesale IP communications to provide direct access to new features and services,” says CTO of Shango, Evin Hunt. “With Shango, CSPs can now to simplify and better manage service fulfillment and instantly transact with any IP services provider in one place,”

“Now, emerging service providers can easily source services from multiple vendors, and those that want to tie in voice functionality can access the services they need through a single interface,” Hunt explains “The marketplace also enables carriers and network operators to transcend legacy constraints by setting up their inventory within it, and more easily offer up the new types of services and applications that their customers are demanding, he continues.”

In just its first year, the Shango marketplace has already facilitated more than 5 million transactions across a plurality of voice and data applications for more than 1,400 trading partners. Shango marketplace members include Tier 1 global telcos and other leading providers of DID and toll-free telephone numbers; CNAM, E911 and SMS features; hosted PBX (News - Alert) and routing platforms; and even providers of cloud applications like video conferencing, as well as back office solutions such as billing and storage, which are also in the ever-expanding marketplace ecosystem.

.png)

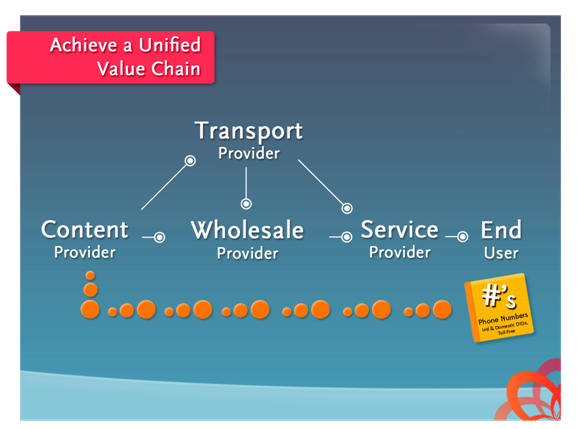

Amidst the evolution of the telephone and the phone number, new emerging players such as application providers are bringing new over-the-top (OTT) applications, features and services to market to be sold to a variety of end-users; simply by tying voice services and numbers together in new ways. These applications are changing the customer base of wholesale providers, especially carriers and operators, who are increasingly turning to Shango to enable them to meet and serve this evolution head on.

With the demand for OTT services on the rise, both wholesale providers and their customers have sought an easier way to push out- and pull down IP-enabled services and applications to-and-from one another faster and more seamlessly. Wholesale enablement through the Shango marketplace is allowing both buyers and sellers of IP-enabled services to cross legacy constraints. They are attaining greater autonomy from traditional partners through the marketplace’s carrier-agnostic transport layer, which can also support transactions across all voice services, such as VoIP, wireless, and wireline, enabling them to more easily scale wholesale channels and revenue.

Take for example emerging OTT service providers, such as ITSPs, cloud application providers, and those providing cloud applications through UCaaS or a Cloud Services Brokerage model, which all need the ability to easily source wholesale services. As a member of Shango, an ITSP can aggregate its providers to a single UI and API; likewise a UCaaS provider can gain a single point of integration in order to source and fulfill application from its multiple vendors, and a Cloud Services Broker could more easily source and bundle cloud-based applications and set them up for resale to its own customers.

The need for a simplified service fulfillment is clear. UCaaS subscriber numbers are forecasted to grow sixteen-fold over the next five years, and UCaaS revenues expected to grow almost as quickly, according to Synergy (News - Alert) Research Group. The global research and advisory firm Gartner has also predicted that IT expenditure on cloud services expected to hit the $100 billion mark by 2014, indicating a great need to reduce IT capital and operating expenses.

Similarly, carriers that want to grow existing wholesale channels or to serve new types of OTT applications to new markets can easily offer up their inventory, or even incorporate OTT offerings into their own value-added services. Within Shango, they can identify new revenue streams for new products by leveraging an ecosystem of new potential customers already buying services from existing- and new partners active within the marketplace. Indeed, telecom revenue mix forecasts point to an increasing shift toward wholesale and “smart” operators, with 50 percent of service provider revenues expected to come from wholesale/indirect channels by 2020, according to 2012 data from Ernst & Young.

As it stands today, infrastructure complexities plaque wholesale supply chain and distribution processes. Plus, with various B/OSS and activation systems on the backend, alternate solutions would require providers to overlay customer-specific multi-tenancy and differing workflows to various trading partners. Further, every new partner or customer relationship would require new agreements, processes, features, and services that need to be enabled. Not to mention, the possibility that new APIs that would need to be developed or augmented, and in the case of many legacy carriers, they may not even be available.

While many ITSPs have invested in certain systems and technologies to improve activation and provisioning intervals, the reality is that today many carriers and operators are still bound by legacy assets that can’t meet the technical demands of their customers; and who themselves don’t have the IT or human capital to handle the manual swivel chair processes required to orchestrate or pull down services directly. In fact, these are the same buyers of wholesale services that are increasingly growing accustomed to real-time access, like pulling applications down from “app stores,” causing carriers to rethink everything from activating and orchestrating services, to everyday MACDs required for meeting demand.

Much like Amazon.com (News ![]() - Alert) lets vendors set up a store front and present inventory, and then handles order fulfillment through its back-end systems, Shango does the same thing for wholesale buyers and sellers of IP communications. Suppliers put their inventory in the marketplace, and buyers can pick out their services and features through one point of integration.

- Alert) lets vendors set up a store front and present inventory, and then handles order fulfillment through its back-end systems, Shango does the same thing for wholesale buyers and sellers of IP communications. Suppliers put their inventory in the marketplace, and buyers can pick out their services and features through one point of integration.

The marketplace, through its platform and simultaneous workflow handles all necessary orchestration, activation and service fulfillment, bonding selected services and features to a number, hosted seat, or OTT application. Within the marketplace, sellers, called “Merchants,” can offer a single point of integration across a portfolio of network service offerings to buyers– who in turn can more easily source services from new and existing providers. Even sellers without an API can post inventory and make it searchable for buyers to pull down products instantly. Likewise, a buyer can turn around a reverse API and offer up its services, such as OTT features and applications to carriers and operators who want to expand their own service portfolios.

The numerous buyers and sellers already engaged in the marketplace echoes a desire to move beyond the legacy of traditional operations– just as the phone number has been released from the confounds of the telephone network, now connected to a range of devices and people, in a verve of greater mobility and elasticity, service providers are also charged with intent of evolving their business relationships, interactions, transactions and revenue growth through greater autonomy.

The marketplace’s ability to flex value chains, and pre-integrate to various platforms for activation and fulfillment has enabled wholesale provider members to earn new revenues from existing network assets, and bridge the buy/sell relationships from just a small number of traditional telephony providers, to making the most of new and emerging customer bases.

|

How Buyers Benefit from the Shango Marketplace

|

How Sellers Benefit from the Shango Marketplace

|

While in the past it used to be enough to release some new features every year or two, today’s CSPs need to be able to bring new offers to market quickly as customers demand of them and as opportunities present themselves. The reality is that those CSPs who don’t move on such opportunities will find themselves at risk of losing business to competitors, be they facilities-based outfits or new OTT service providers.

Today, the marketplace’s activation and fulfillment engine helps to mitigate that risk by simplifying interactions and transactions across disparate partners, applications, and service providers, helping them remain relevant in what has quite rightly been deemed the age of acceleration.