Last issue I talked about the web-based communications platform as a service, or CPaaS 2.0, and using all IP communications as part of enabling applications. With CPaaS 2.0 and the original CPaaS 1.0, combined with the vendors offering solutions, there are many options for how to enable your applications.

While Twilio (News - Alert) led the way in CPaaS 1.0, there has been an explosion of new vendors, including Broadband.com and Tata. Traditional premises vendors like Cisco are offering integration APIs for platforms like Spark, and Avaya (News - Alert) has introduced Zang. Mitel was showing an API-based capability across all its PBX platforms at an industry event a few weeks ago. Of four major initial CPaaS/API vendors: Twilio, Tropo, Nexmo, and Corvisa, three were acquired (Tropo-Cisco, Nexmo-Vonage (News - Alert), Corvisa-ShoreTel). And Twilio went public with a market cap of about $3 billion. Clearly all the major enterprise communications players see CPaaS as a critical component of their future offerings.

New players have emerged in the CPaaS 2.0 space. Early players like Tokbox and Kuretno have been acquired (by Telefonica and Twilio, respectively). Meanwhile, other companies like Temasys (News - Alert), Agora, and Ytel are providing complete frameworks that enable applications developers to rapidly integrate real time into their apps including the network characteristics to enable quality real time. Carrier telecom supplier GENBAND has delivered Kandy, a CPaaS 2.0 solution that has seen significant success with large systems integrators and in medical applications.

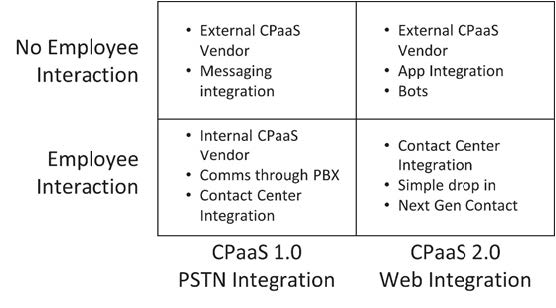

The range of options for how to enable real-time communications in applications has created a new challenge: Deciding which platform or solution to use. The first choice is whether to employ PSTN-based communication or web-based communications capability. The second is whether to use a solution provided by the enterprise communications platform or to use an independent third-party platform. The four choices, as shown in the figure, should be driven by the communications requirements and who is communicating.

If the communications are between employees, or is predominantly involving an employee, using the enterprise communications platform may be best. On the other hand, if most or all of the communications is either with third parties (think an Uber driver talking to the rider) or with employees working away from a corporate location, a third-party CPaaS may be best.

You should consider the following in selecting between PSTN or in-app web-based communications. If the customers will not download an app, then the PSTN/SMS may be best. If the app is downloaded on the user/customer device, then in-app web communications may be best. If the communications require video, then the web in-app approach generally makes more sense.

As during much of the last 15 years in the communications market, changes often come from adjacent markets and vendors that exploit adjacency. Cisco won big in VoIP as it was the dominant enterprise data networking vendor. Microsoft is currently leveraging the adjacency in personal productivity software (Office) to win a significant portion of unified communications business.

The cloud compute integration platform as a service market that delivers platforms to rapidly integrate applications and build business solutions is beginning to communications enable those platforms. In the most recent Magic Quadrant for IPaaS, Gartner identified 17 companies, ranging from Oracle (News - Alert) and SAP to smaller companies. Several of these organizations are looking to add communications capability to their platforms. Meanwhile, traditional telecom players like Avaya are entering the IPaaS market with products like Breeze. And Amazon has introduced both Chime and Connect to integrate communications applications with it IPaaS framework.

CPaaS, both in 1.0 and 2.0 forms, is creating new opportunities for vendors, cloud providers, IT staff, channels, and consultants. Traditional UC capabilities generally are productivity savers for knowledge workers; however, CPaaS changes fundamental business models. For example, if 10 percent of orders have some form of error and not correcting that error results in losing 50 percent of the orders with errors, a CPaaS solution that eliminates 50 percent of those errors will result in a 2.5 percent increase in revenue. For many businesses that are already operating past the profit point, this level of additional business could result in an additional 1 percent profit. For a business with a 10 percent profit margin, that 1 percent increase is a 10 percent increase in profitability. And that results in better business evaluations and stock prices.

In this time of unprecedented change, cloud pricing pressure, and other shifts, CPaaS (and IPaaS with communications) is opening new doors to add value, focused not on communications alone, but on changing the business processes and strategic market approaches.

Phil Edholm is with PKE Consulting LLC (www.pkeconsulting.com).

Edited by Erik Linask