TMCnet News

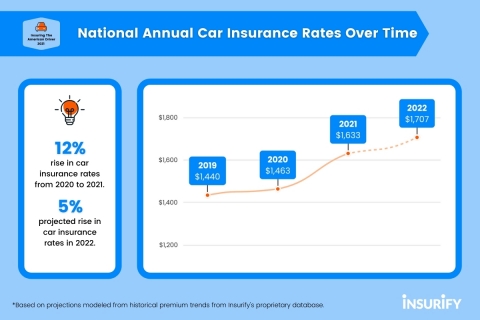

New Report from Insurify Reveals 12% Increase in Car Insurance Rates and COVID-19's Impact on Car Insurance and Driving BehaviorsInsurify, America's leading car insurance comparison platform, has released its second annual Insuring the American Driver report, revealing a 12% increase in car insurance costs in 2021 compared to 2020. The average American driver is now paying $1,633 a year for coverage-a price the report projects will rise 5% to just over $1,700 in 2022. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211118005731/en/

Auto insurance costs have risen 12% between 2020 and 2021, and are expected to rise even more in 2022. (Graphic: Business Wire) Insurify's research team analyzed over 40 million car insurance quotes across the United States to detail recent trends in auto insuranceand driving behavior and to examine how COVID-19 continues to affect each of these areas. As part of its analysis, the report explores current rates of reckless and aggressive driving behaviors, an unsettling trend that surged during the COVID-19 pandemic, showing that such patterns continue to persist past the lifting of restrictions and lockdowns. For example, driving-related fatalities per mile driven increased 26% in the period between March and May 2021 compared to the same period in 2019-a level only 3% lower than 2020 highs. As traffic levels gradually return to pre-pandemic levels, heightened fatality rates that marked the pandemic are remaining elevated. "With inflation over 5%, driving rates returning to pre-pandemic levels, and rising collisions, there are many factors leading to increased auto insurance prices," says Kacie Saxer-Taulbee, Head of Research and Content at Insurify. "Even when you set aside economic factors, drivers are expressing a distinct difference in their experience on the roads in 2021, with 38% reporting driving more frequently and 44% witnessing more aggressive driving." It's not out of the question that these elevated levels of reckless driving behavior and fatality rates may be contributing to the surge in auto insurance rates. On average, aggressive drivers pay 25% more for car insurance compared to a policyholder with a clean record. Insurify's 2021 Insuring the American Driver report also shows insights into self-reported driver behavior from a survey of over 1,000 drivers: - 44% drivers witnessed more aggressive driving on the roads in 2021 - 38% drivers reported that they are driving more in 2021 than in 2020 - 41% report an increase in their car insurance premiums year over year See Insurify's Insuring the American Driver Report for more insights on the elements driving pricing trends in 2021 as well as a look ahead to car insurance costs in 2022! About Insurify Based in Cambridge, MA, Insurify is a leading virtual insurance agent that empowers customers to compare, buy and manage their auto, home and life insurance policies all in one place. With over $170B of insurance coverage purchased and over four million satisfied customers, Insurify has achieved 50x revenue growth since 2016 and won several insurance industry awards, including: Stevies' Gold International Business Award for a Medium-sized Insurance Company 2021, Inc.'s 5000 fastest-growing private companies in America of 2021, EY's 2021 New England Entrepreneur of the Year, and Insurtech Insights' Future 50 2021. Compare car insurance with Insurify today!

View source version on businesswire.com: https://www.businesswire.com/news/home/20211118005731/en/ |