TMCnet News

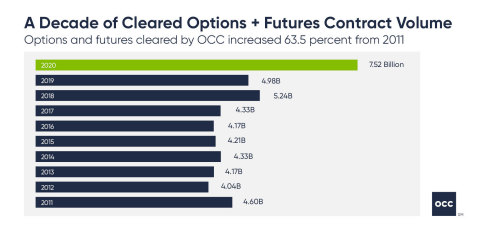

OCC Clears Record-Setting 7.52 Billion Total Contracts in 2020OCC, the world's largest equity derivatives clearing organization, announced today that it set new annual cleared contract volume records for the U.S. exchange-listed options industry. In 2020, OCC cleared 7.52 billion total contracts and 7.47 billion options contracts. These numbers surpass the previous records, set in 2018, of 5.24 billion total contracts and 5.14 billion options contracts. Compared to 2019, OCC had a 51.2 percent increase in total contracts cleared and a 52.4 percent increase in options contracts cleared. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210105005208/en/

(Graphic: OCC) "In 2020, we witnessed record volumes in both trades and contracts for the U.S. equity options markets," said John Davidson, OCC's Chief Executive Officer. "Our performance during 2020's unprecedented markets underscores how industry utility central counterparty clearinghouses (CCPs) like OCC benefit the investing public by underpinning markets, promoting stability and market integrity. We remain committed to delivering efficient and effective clearance, settlement and risk management to our participating exchanges, clearing member firms and market participants." Additionally, December cleared contract volume was the highest month in OCC's history at 756,963,242 contracts, surpassing the previous monthly volume record set in June 2020 of 693,042,180 contracts and up 80.9 percent compared to December 2019. Full year average daily cleared contract volume for 2020 was 29,739,747 contracts, up 50.6 percent from 2019. "With nearly 98 percent of our OCC colleagues working remotely, we are proud of OCC's resiliency and ability to scale our processing in order to deliver our services in keeping with the high quality standards we have set for ourselves and which market participants have come to expect from us," said Scot Warren, OCC's Chief Operating Officer. "We have done this while continuing our transformation through the Renaissance initiative. When completed, Renaissance will deliver increased business agility, more efficient and effective operations and technology that is scalable and more resilient. These benefits will reinforce the confidence we have built in OCC's ability to deliver in all types of market conditions." Options: Total exchange-listed options cleared contract volume for 2020 reached 7,467,025,538, up 52.4 percent from 2019. December 2020 options volume was 753,568,354, up 82.9 percent from December 2019. Equity options cleared contract volume reached a total of 7,004,304,148 in 2020, up 58.5 percent from 2019. This includes 2020 total ETF options cleared contract volume of 2,566,007,029, an 44.2 percent decrease. December 2020 equity options volume was 719,646,140, up 92.5 percent from December 2019. This includes December 2020 ETF options volume of 195,215,692 contracts, up 33.4 percent compared to December 2019. Index options cleared contract volume for 2020 was down 3.3 percent with 462,721,390 contracts. December 2020 index options volume was 33,922,214, down 11.2 percent from December 2019. OCC's year-to-date average daily cleared options volume for 2020 was 29,513,935 contracts. Futures: Total futures cleared contract volume for 2020 was 57,130,360, a 26.7 percent decrease from 2019. December 2020 futures contract volume was 3,394,888, a 47.2 percent decrease from December 2019. OCC's year-to-date average daily cleared futures volume for 2020 was 225,811 contracts. Securities Lending: The average daily loan value at OCC in December 2020 was $100,806,194,910, a 21.2 percent increase compared to December 2019. Securities lending CCP activity increased by 22.8 percent in new loans from December 2019 with 126,355 transactions last month. For 2020 monthly exchange market share information, click here.

About OCC OCC is the world's largest equity derivatives clearing organization. Founded in 1973, OCC operates under the jurisdiction of both the U.S. Securities and Exchange Commission (SEC (News - Alert)) as a registered clearing agency and the U.S. Commodity Futures Trading Commission (CFTC) as a Derivatives Clearing Organization. Named 2020 Best Clearing House - Equities by Markets Media for the third consecutive year, OCC now provides central counterparty (CCP) clearing and settlement services to 20 exchanges and trading platforms for options, financial futures, security futures, and securities lending transactions. More information about OCC is available at www.theocc.com. Copyright © 2021. The Options Clearing Corporation. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210105005208/en/ |