TMCnet News

Corbin Advisors' Latest Industrial Sentiment Survey Finds Significant Erosion in Growth Outlooks and Dramatic Shifts in Sector ViewsCorbin Advisors, a research and advisory firm specializing in investor relations (IR), today released its quarterly Industrial Sentiment Survey, which recorded a significant pullback in positive investor sentiment, perceived management tone and economic expectations for the world's largest economies. The survey, part of Corbin Advisors' Inside The Buy-side® publication, is based on responses from 30 institutional investors and sell-side analysts globally who actively follow the Industrial sector. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190118005292/en/

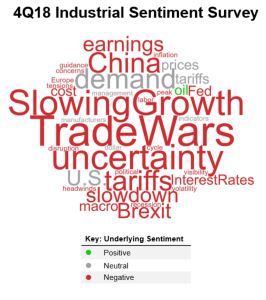

Word Cloud: Frequency of Occurrence (Graphic: Business Wire) Our survey reveals a pervasive belief that global growth is indeed slowing and positive sentiment is ebbing as those reporting a Bullish or Neutral to Bullish stance fall to 48% from 67% QoQ. Furthermore, expectations for earnings beats, which hit an all-time high in last quarter's survey, fell to 30% from 54%. Still, only 3% purport to be outright Bearish. Expectations for all key performance metrics fell to their most pessimistic levels since June 2016, when a persistent low growth outlook dominated investor views. Half expect revenue growth to have deteriorated in 4Q18, wile 41% anticipate EPS growth to worsen. Notably, slightly more believe margins will remain intact QoQ amid confidence in management's ability to offset cost headwinds. Looking ahead, 57% of survey respondents anticipate weaker FY 2019 guidance versus 2018. Expectations for 2019 Industrial organic growth slipped to a range of 3.0-4.0%, down from 2018's robust 5.0%+ outlook. Our survey also finds that 42% of contributors expect Industrial earnings to peak in 2019, while those suggesting the cycle has already peaked spiked to 29% from 9% QoQ. We identified significant shifts in sentiment on regions and end markets, as nearly half expect Global PMI to Worsen over the next six months, while 59% and 67% predict the same for China and the Eurozone, respectively. Brazil registered the most optimistic expectations, as more than half, or 54%, expect the region to improve. "After a gut-wrenching end to 2018, with executives weathering mounting pressures from trade wars, slowing global growth and rising input costs, investor sentiment is significantly more downbeat as we enter a potentially volatile earnings season for Industrials," commented Rebecca Corbin, Founder and CEO of Corbin Advisors. "The rapidity and magnitude of the shift in both the economy and investor sentiment is notable. In this scenario, investors are seeking recession-tested management teams and placing greater emphasis on balance sheet strength, specifically, low leverage levels and ability to generate strong free cash." Corbin added. Several sectors saw a massive increase in negative sentiment. To that end, 65% of contributors believe Housing/Residential Construction will Worsen over the next six months, with the sector seeing the sharpest jump in bearish sentiment, from 13% to 59% QoQ. For over eight consecutive quarters, Auto remains the leading sector expected to Grow Slower than GDP, registering a significant spike in bearish sentiment to 87% from 62% QoQ. On a bright note, Commercial Aerospace, Defense and Water saw increases in investor confidence. Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at www.CorbinAdvisors.com. About Corbin Advisors Corbin Advisors is a specialized investor relations (IR) advisory firm that partners with C-suite and IR executives to drive long-term shareholder value. We bring third-party objectivity as well as deep best practice knowledge and collaborate with our clients to execute sound, effective investor communication and engagement strategies. Our comprehensive services include perception studies, investor targeting and marketing, investor presentations, investor days, specialized research, and retainer and event-driven consulting. Inside the Buy-side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC. To learn more about us and our impact, visit www.CorbinAdvisors.com. View source version on businesswire.com: https://www.businesswire.com/news/home/20190118005292/en/ |