TMCnet News

Corbin Advisors' Latest Buy-side Survey: While Investor Optimism Remains Strong, There Is Continued Deterioration in Positive TrendsCorbin Advisors, a research and advisory firm specializing in investor relations (IR), today released its quarterly Inside The Buy-side® Earnings Primer report, which captures trends in institutional investor sentiment. The survey is based on responses from 79 institutional investors and sell-side analysts globally, representing over $790 billion in assets under management. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181012005242/en/

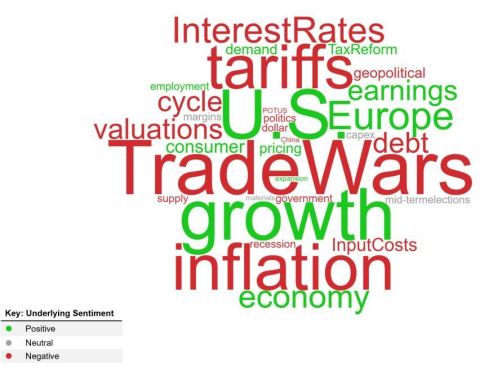

(Graphic: Business Wire) While surveyed investors remain optimistic for strong 3Q18 performance, sentiment continues to temper as U.S. corporations battle mounting headwinds. Indeed, nearly 80% express Moderate to High concern with China tariffs and rising input costs. While management outlooks remain constructive, the number of investors describing management tone as Neutral to Bullish or Bullish fell to 72% from 78% last quarter. "My sentiment is neutral. Although the economy is performing well, we are waiting to see if this is temporary due to the tax laws and continued trade direction," commented Steven Gattuso, Portfolio Manager at Courier Capital. Despite markets recently hitting all-time highs, fewer than 50% classify U.S. equities as Overvalued, in line with last quarter and more than 4% expect U.S. equity valuations to Expand, with Net Buyers more than doubling Net Sellers. "Heading into the third quarter earnings cycle, our research identifies softening in sentiment, which is not surprising given the significant headwinds companies are facing and attempting to address," commented Rebecca Corbin, Founder and CEO of Corbin Advisors. "There is clearly the potential for some weakness following record equity market performance in 2Q. As consumer confidence reaches an 18-year high, there is a growing concern that consumer-level price increases related to input cost inflation and tariffs will emerge in the months ahead. The effect of rapidly rising prices elevates the risk of a less favorable macro heading into 2019. For now, the air is being let out slowly but we see a real scenario where market sentiment could deteriorate further. Defensive stocks gained favor this quarter and investors in general continue to place significant emphasis on balance sheet strength." added Ms. Corbin. Corbin Advisors' proprietary research indicates Net Debt-to-EBITDA thresholds continue to grow more conservative, with a preferred range of 5.0x-5.5x for REITs in general, a shift from 6.0x in 2016, and 2.0x-2.5x for nearly all other sectors, down from 3.0x over the same timeframe. As for sector views, Healthcare sees the most positive sentiment level since June 2015, while Tech bears more than triple. Amid corporate cost actions in play since 1Q18, Consumer Discretionary sees pressure from both ends - fewer bulls and more bears. Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at CorbinAdvisors.com. About Corbin Advisors Corbin Advisors is a specialized investor relations (IR) advisory firm that partners with C-suite and IR executives to drive long-term shareholder value. We bring third-party objectivity as well as deep best practice knowledge and collaborate with our clients to execute sound, effective investor communication and engagement strategies. Our comprehensive services include perception studies, investor targeting and marketing, investor presentations, investor days, specialized research, and retainer and event-driven consulting. Inside The Buy-side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC. To learn more about us and our impact, visit CorbinAdvisors.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20181012005242/en/ |