TMCnet News

Identity Fraud Cost Nearly Half a Million US Dollars to Every Third Bank Last Year, Says Regula Global SurveyA global survey* conducted by Regula together with Sapio Research company from December 2022-January 2023 has revealed that the impact of identity fraud varies for organizations in the Financial Services industry, based on whether they belong to the Banking or FinTech sector. Specifically, every fourth bank reported experiencing over 100 identity fraud incidents in the past year (26% of organizations), while this number is lower (17%) for the FinTech sector. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230329005499/en/

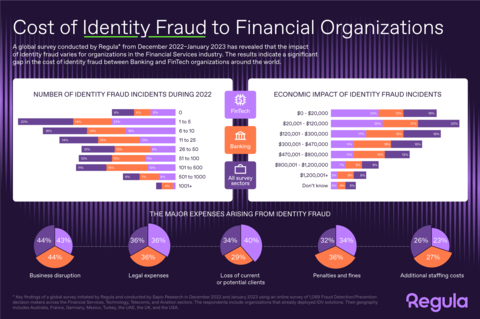

Cost of Identity Fraud to Financial Organizations. A global survey conducted by Regula from December 2022-January 2023 has revealed that the impact of identity fraud varies for organizations in the Financial Services industry. The results indicate a significant gap in the cost of identity fraud between Banking and FinTech organizations around the world. (Graphic: Business Wire) Economic damage. When asked to evaluate the cost of the identity fraud they had experienced, the Banking sector was found to be the most severely impacted, with a median financial burden of over $310,000. In fact, for 31% of banking organizations, the cost of such incidents was nearly half a million dollars, at $479,000 and more. On the other hand, the same indicator of the median cost of fraud for FinTech organizations was considerably lower, at around $120,000. This amount was even lower than the median across all surveyed sectors, which included Aviation, Technology, Telecom and Financial Services, with the organizations reporting a median of expenses of up to $240,000. The gap may be a reflection of the larger scale and complexity of banks' operations, their legacy systems, as well as the regulator and reputational risks they face. On the other hand, Fintech companies may have smaller customer bases and be subject to less regulation. The following survey results provide support for this idea. Collateral effect. The key costs affecting organizations across all sectors due to identity fraud are related to business disruption (44%) and legal expenses (36%). However, the situation is somewhat different for financial organizations. Specifically, for the Banking sector, the second-largest cost resulting from identity fraud is penalties and fines (36%), while for FinTech organizations, it is the loss of current and potential clients (40%). Most common type of identity fraud. Last year, the most prevalent form of fraudulent activity experienced by organizations in all surveyed sectors was the use of fake or modified physical documents. Nearly half of FinTech companies (46%) reported being affected, while for banks, such cases were even more frequent: 54% of them reported dealing with document forgery in the past year. "The rapid digitization of the Financial Services sector has led to an increase in identity fraud, as fraudsters take advantage of the lack of physical presence required for identification. Although physical ID verification is the most reliable, organizations are increasingly turning away from it due to scalability, cost and user experience issues. To effectively combat identity fraud in the digital age, organizations must implement secure and reliable identity verification processes, leveraging advanced ID verification technologies and expertise in document security features," says Ihar Kliashchou, Chief Technology Officer at Regula. It's no surprise that in this context, 93% of organizations recognize the significance of online identity verification in detecting and preventing fraud. Notably, in the USA, 99% of companies share this view. To ensure truly fraud-resilient identity verification, companies require a comprehensive IDV solution that allows for both document and biometric checks. The many offerings available on the market may lead one to believe that it's necessary to combine a number of various standalone IDV products, but in fact, businesses can get everything from one vendor, such as Regula. Not only do Regula's IDV solutions perform flawless checks of nearly all types of identity documents, but they also match a persons' selfie with their document and carry out liveness checks to ensure you're dealing with a real person, not a presentation attack. Regula's IDV solutions are successfully used at 80 borders all over the world, where they help prevent identity fraud and contribute to public security. *The research was initiated by Regula and conducted by Sapio Research in December 2022 and January 2023 using an online survey of 1,069 Fraud Detection/Prevention decision makers across the Financial Services (including Banking and FinTech), Technology, Telecoms, and Aviation sectors. The respondent geography included Australia, France, Germany, Mexico, Turkey, the UAE, the UK, and the USA. About Regula With our 30+ years of experience in forensic research and the largest library of document templates in the world, we create breakthrough technologies in document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security or speed. Regula was named a Representative Vendor in the Gartner® Market Guide for Identity Proofing and Affirmation in 2022. Learn more at mobile.regulaforensics.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230329005499/en/ |