|

Traditional business views would lead one to conclude that mobile network operators (MNOs) and cable multiple system operators (MSOs) will ultimately compete for subscriber ownership. Actually, if you consider that most MNOs are principally owned or controlled by the incumbent wireline carriers, they already do. But, it is the consumers who ultimately drive service provider behavior, and consumers (wireless, and cable MSO subscribers alike) prefer to create and control applications when and were they want, irrespective of the underlying network (of which they are probably not even aware of its origin). Assuming consumer demand is adhered to, then, like it or not, MNOs and MSOs are going to have to develop business models that leverage their common strengths and objectives. Fortunately, there is a logical alternative to what would ultimately prove to be fruitless competition for subscribers: coopetition. In fact, coopetition may be the only way for the MSOs and MNOs to jointly or

individually succeed.

Actually, the industry is already headed in the direction. The rapidly evolving network technology landscape, including the 3GPPs IP multimedia subsystem (IMS) SIP-based architecture and the interrelated, forthcoming PacketCable 2.0 specification, will not only support this reality, but will also contribute to the inevitable coopetition between these two network operators. In their 1996 landmark management book, Co-Opetition, where game theory is applied to business strategy, Adam Brandenburger and Barry Nalebuff suggest that the appropriate mix of cooperation and competition between firms producing related products (or services as the case may be) should lead to market expansion. Further research suggests that a pivotal characteristic of successful coopetive relationships is a partially convergent interest (goal) structure, which leads to the joint value creation (Dagnino, Battista, Padula, 2002). What does this mean in the marketplace? There are examples of successful coopetive relationships across

multiple sectors and industries including automobile (Volkswagen and Porsche), oil (Chevron and BP), Internet (AOL and Google), and in technology, one of the most notorious, successful relationships based on coopetition: Microsoft and Apple. MSOs and MNOs should ultimately be included in this list as their respective goals to reduce churn, find and realize incremental revenue streams, and optimize costs will lead them to conclude that working together is the most effective way to not only lock up existing subscribers but potentially grow that share of the wallet spend.

Irrespective of the timing for IMS and PacketCable 2.0 to support applications and devices across networks, MSOs have an immediate opportunity to add cellular service as part of their product bundle. MSOs have demonstrated that product bundling is a very cost effective way to compete, and it is this bundling approach that is inconspicuously driving the first step towards cooperation between cable and mobile operators. As MSOs begin to resell cellular service, they are becoming mobile virtual network operators (MVNOs). While the joint venture between Sprint Nextel and four U.S. MSOs (Comcast, Cox, Bright House Networks, and Time Warner) is currently the most visible example in the cable sector, most domestically operating MNOs offer the wholesale network access necessary to support an MVNO approach. From a subscriber perspective, the MSO is offering the quad play, and the  expanded bundle

reinforces the MSO brand and customer relationship, further reducing churn (four products are more sticky than three). expanded bundle

reinforces the MSO brand and customer relationship, further reducing churn (four products are more sticky than three).

It also provides the MSO with the one product that their wireline competitors have been able to leverage to differentiate themselves from the MSOs in the past: wireless service.

The threat of cannibalization has not impeded the MNOs from wholesaling their networks, for two very important reasons:

1. The MNOs still retain key differentiators, such as wholesale access to all applications and content, and

2. The MNOs have not yet fully committed to support network mobility as part of the wholesale MVNO deals. Furthermore, MNOs can offer free nights and weekends and mobile-to-mobile minutes as competitive, appealing marketing offers, allowing the MNOs to remain distinctive.

For an MSO to replicate these marketing offers, they will incur wholesale variable costs to terminate nights and weekends and mobile-to-mobile minutes. Despite this, MVNO wholesale deals are proliferating and MSOs will begin deploying bundled cellular service in stages over the next 12 months.

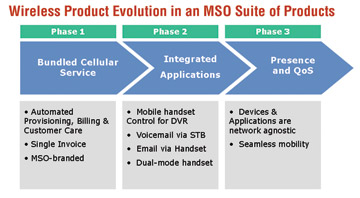

What does this mean for the subscriber? As the MSO and MNO coopetive model develops, subscribers gains the ability to access and control applications via multiple devices both within and outside the home. This capability will evolve from the initial bundled wireless service, to integrated applications based on Web-based architectures, and then to presence-based applications supported via an IMS architecture as the latter is adopted by the MNOs and MSOs (Figure 1) . Each phase of this evolution will enable the subscriber to achieve increased utility and value, first through bundled discounts, then from integrated applications and ultimately through presence-based applications. As this evolution occurs, the relationship between the MSOs and MNOs should result in higher utilization and in greater market expansion opportunities, as suggested by the coopetition concept. But beyond the theoretical analysis, there are

substantive, aligned commercial interests to drive the coopetive relationship including churn

reduction and the Halo Effect. . Each phase of this evolution will enable the subscriber to achieve increased utility and value, first through bundled discounts, then from integrated applications and ultimately through presence-based applications. As this evolution occurs, the relationship between the MSOs and MNOs should result in higher utilization and in greater market expansion opportunities, as suggested by the coopetition concept. But beyond the theoretical analysis, there are

substantive, aligned commercial interests to drive the coopetive relationship including churn

reduction and the Halo Effect.

Churn Reduction and the Halo Effect

Bresnan Communications, a mid-sized domestic cable operator spanning about 550,000 homes across Colorado, Montana, Utah, and Wyoming, has stated publicly that they experience 40 percent lower churn from subscribers that also take their voice product. Equally noteworthy, 30 percent of voice subscribers are new Bresnan subscribers (defined as not having been a subscriber for preceding six months) with 96 percent taking at least two products and 76 percent opting for the triple play bundle. These numbers support the theory that there is a marketing Halo Effect associated with the voice product, which leads the subscriber to view the MSO brand (and by extension, other MSO products) with the same perceived value as the voice product. As such, Bresnan, and other MSOs offering voice have been very successful upselling subscribers to bundles of products. Drawing upon this line of reasoning, it is reasonable to conclude that the voice Halo Effect could easily apply to an MSO-branded cellular product, and as

such, a four-product bundle could potentially reduce churn by more than the 40 percent currently experienced by Bresnan.

As cellular penetration rates reach saturation, MNOs need to find ways to acquire subscribers from competitive wireless providers, as well as reduce their own subscriber defection. In a wholesale coopetive partnership with MSOs, the MNO benefits from the Halo Effect described above, and thus the MNO improves its ability to grow their market vis--vis competitive, standalone cellular product offers. Correspondingly, any incremental churn reduction realized by the MSO due to the bundled wireless product, results in the churn reduction for the MNO.

Incremental Revenue Opportunities

In addition to the conventional bucket-of-minutes revenue generated through cellular subscriptions, consumers have indicated a willingness to pay for wireless services that can and will be connected to the quad play. Utilizing existing basic IP Web infrastructure, the MSO and MNO can enhance and extend subscriber control inside and outside of the home. Delivering value via subscriber control will manifest itself in applications that enable the MSO and MNO to coopetively capture incremental revenue opportunities including: personal e-mail access via the mobile handset, reviewing and managing both wireline and wireless voice mail via the TV, and DVR control via the mobile handset. In the last example, a subscriber could use the mobile phone interface to direct the DVR to record a program when they are away from home.

Cost & Quality Optimization

Fast forward to Phase 3 of the wireless product evolution: assume that affordable dual-mode handsets (i.e., WiFi and cellular capable) are widely available, and that both cable and mobile network operators have incorporated fundamental IMS principles into their respective networks, which allow for presence detection. In a coopetive relationship, the MSO and MNO would agree on program logic to originate and terminate voice minutes over whichever network maintains the best signal level, or QoS while optimizing the network cost structure. This same logic applies to any presence application whether person-to-person or person-to-application, including any combination of voice, video, and data.

Whether due to churn reduction, incremental revenue, or network cost optimization, cable and mobile networks operators have the necessary convergent goal structure to justify pursuing a cooperative partnership. The likelihood that this paradigm will materialize between the cable and mobile carriers hinges on their joint and respective willingness to share the subscriber. Conceptually, this goes against their normal instinct to maintain control of the subscriber at all costs. But the concept of coopetition suggests that the MSOs and MNOs will need to break free from traditional thinking. A closer analysis should lead them to conclude that their convergent interests will expand their market opportunity, resulting in value creation and this conclusion should be compelling enough to overcome their initial innate reaction. It remains to be seen whether the MSOs and MNOs will see that, when it comes to competing for wireless subscribers, their collective whole is greater then the sum of their individual

parts. IT

Mike Pastor is president, Net2Phone Cable Telephony LLC (news -alerts). For more information please visit the company online at www.net2phone.com/cable.

If you are interested in purchasing reprints of this article (in either print or PDF format), please visit Reprint Management Services online at www.reprintbuyer.com or contact a representative via e-mail at [email protected] or by phone at 800-290-5460.

|