The investment community is starting to ask, “Is there real money to be made in M2M/IoT”? For those who spend a considerable amount of time with the investment community, the practice of just counting connections in the M2M/IoT world is becoming stale. Wall Street wants to know where the actual revenue value in the M2M/IoT market is and not inflated data which is the size of some GDP’s. Those that are presenting outlandish revenue figures are destroying their credibility on Wall Street, because the investment community knows it is fluff.

In order to show real value, connections must be accompanied with ARPU; this is where the rubber meets the road. The two metrics must go hand in hand with each other in the M2M/IoT market. The investment community has witnessed the hype machine before in various markets and they are somewhat skeptical when the discussion centers on connections. This is why they want to see the actual money trail and who is signing what deals and the impact it will have on their respective market. For example, the investment community knows if you add 400k connections and the ARPU is approximately a $1, which is not a lot of money. However if the ARPU numbers are north of $5, that tells a different story to Wall Street. The reality is the investment community is very analytical and they are not falling for the hype.

Transitioning to Growth Stage

One of the challenges for an emerging market is to show growth and investors understand that. For the M2M/IoT market, connections were a logical choice. A connection was the best way to illustrate growth in the initial market development stage of M2M/IoT. Since the market is moving beyond the evangelism stage, and transitioning to the growth stage, C-level executives need to continue challenging their teams on finding high value connections versus low value ones. This is what the investment community really wants to hear at the moment. Furthermore, several investment firms have teams that track several vertical markets that M2M/IoT companies are trying to penetrate and they know the landscape very well. Wall Street understands there is money to be made but they want to have confidence in companies that know where the value lies.

To give an illustration, if we examine a carrier such as Verizon (News  - Alert), we know they are growing in the M2M/IoT space. Some might ask, “What is the secret to their success?” The company is targeting high value ARPU accounts and they are not even presenting connection information. Some of their MVNO partners in M2M market that use multiple carriers are also noticing they are making more money with Verizon versus others. In several instances, they have significantly fewer connections with Verizon but the revenue coming in is much greater. This is causing a cultural shift with some MVNOs as they shift their focus to higher ARPU accounts.

- Alert), we know they are growing in the M2M/IoT space. Some might ask, “What is the secret to their success?” The company is targeting high value ARPU accounts and they are not even presenting connection information. Some of their MVNO partners in M2M market that use multiple carriers are also noticing they are making more money with Verizon versus others. In several instances, they have significantly fewer connections with Verizon but the revenue coming in is much greater. This is causing a cultural shift with some MVNOs as they shift their focus to higher ARPU accounts.

The other challenge the C-level suite has; managing internal politics and different views on how to grow in the M2M/IoT market. The reality is that several performance metrics for those that participate in this market are based on connections, which is why several within organizations gravitate towards it. This approach was good at first but one would have to question is it really adding to the bottom line, especially when you consider all of the costs. Another layer of internal complexity is the debate regarding a company to take a vertical or horizontal approach to M2M/IoT. The answer to that one is quite simple: “How do customers view the product/solution and what are the differences between markets?”

For those that are not in the C-level suite and have aspirations of moving up in their careers, one of the key roles of a CEO is to maximize shareholder value. If you look at the business from this standpoint, high value ARPU is the name of the game. Without it, does M2M/IoT bring in enough revenue to justify the team? This is basically what Wall Street is asking when they look to invest.

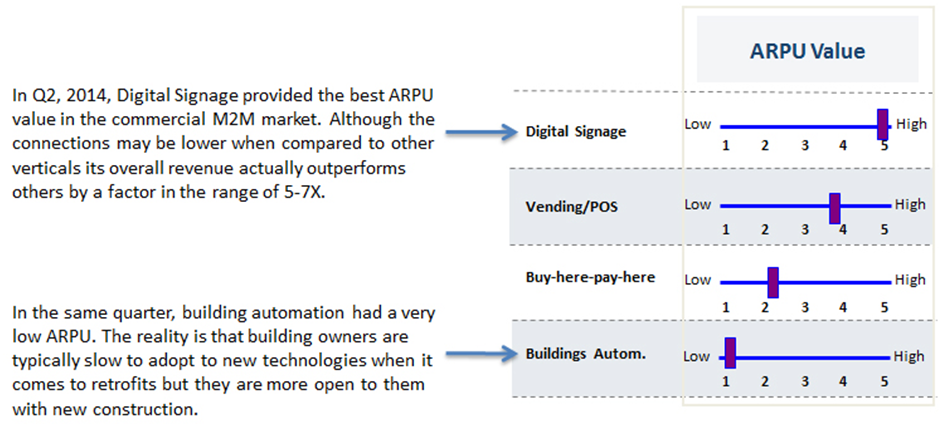

Compass (News - Alert) Intelligence conducts a quarterly tracker where we evaluate connections, ARPU and revenue. One might ask where are the high value ARPU’s for Q2, 2014 and how is it changing over time. For upcoming quarters we provide that exclusively for our subscription clients, but the chart below provides what we witnessed as the best two high value connections during Q2, 2014 and the two lowest ARPU markets during the quarter.

Top 2 High ARPU Markets and Lowest 2 ARPU Markets

(click to enlarge)

Final Thoughts

The difference that M2M/IoT has over other hyped markets in the past is that this sector has a real chance to experience substantial revenue gains. This belief is based on potential end-users examining the benefits of M2M/IoT and it has the ear of the C-level suite. However, the winners in this market will be the ones that know how to work with companies they are not accustomed to working with and truly understand the ecosystem of each vertical market. Furthermore, it will require companies to push past the marketing hype stage which creates unrealistic expectations and undermines the credibility of the overall industry. For example, if one solution fails, the overall industry suffers because customers will think M2M/IoT doesn’t deliver on its promises.

Edited by Alisen Downey