|

As traditional circuit-switched telephony services become applications

using global IP (Internet protocol) data networks, the need for

authorizing and billing inter-IP domain traffic will grow. This commercial

function, known as clearing and settlement in circuit-switched telephone

networks, presents a major new revenue opportunity for IP carriers.

Clearing and settlement lets IP carriers duplicate the functionality of

a wholesale circuit-switched network, but at substantially lower costs:

it is the economic process of compensating interconnected networks for

shared traffic.

To enable revenue sharing among network providers involved in the

origination and termination of VoIP/FoIP (Voice over IP/Fax over IP)

traffic, there must be an efficient mechanism to securely authorize, route,

and rate individual calls; and to allocate or transfer revenue to the network

providers who terminate traffic at their gateways. Clearing and settlement

is the critical commercial enabler of IP telephony. Without this tracking

mechanism, there would be little revenue incentive to originate or

terminate IP telephony traffic.

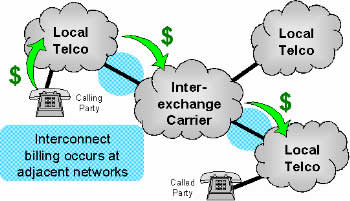

INTERCONNECTION MODELS

The following sections illustrate interconnection models for existing

circuit-switched telephone networks, the World Wide Web, and IP telephony.

Circuit-Switched Interconnection

The interconnection model for the traditional circuit-switched telephone

network is shown below:

This model starts with the calling party, who pays for the

call to be completed to the called party. The originating network operator

relies on other networks to complete the call to the called party. The

circuit-switched telephony model works well because each network operator

is compensated for carrying its segment of the call.

Network operators compensate each other for the traffic they exchange

through bilateral interconnection agreements. These agreements specify how

two networks are physically interconnected at the network level. These

agreements also specify how the networks are paid on a business level.

The two interconnected carriers periodically determine how much traffic

they have sent to and received from one another. The traffic exchanges

between the two networks are netted out to yield a net traffic flow. The

net traffic flow is multiplied by the interconnection fee. The result is

a net settlement payment from the net originating network (the calling

party's network) to the net terminating network (the called party's

network).

In the circuit-switched interconnection model, network and business

interconnection occurs between adjacent networks. Network security related

to the exchange of traffic is simple since the networks have a direct

connection between tandem switches. There is no risk of fraudulent

interconnection since each operator has complete control over trunk group

installation and Call Detail Records (CDRs) generated by their switch.

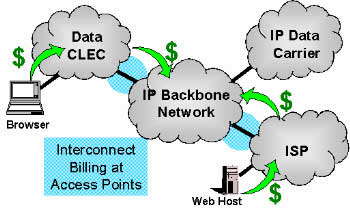

Web Interconnection

The Web interconnection model is different from the

interconnection model for circuit-switched telephony in two important

ways:

First, in the circuit-switched interconnection model, wholesale network

resources are paid for on a usage basis. In the Web interconnection model,

customers and operators pay for access to network resources. With simple

access pricing, interconnection pricing is based on the size of the pipe

used to physically interconnect networks, not the volume or type of

traffic exchanged between networks. For example, a T1 connection may cost a fixed $1,500 per month regardless of the volume of

voice or data traffic exchanged between the networks.

Second, in the circuit-switched model, all service revenues are paid by

the calling party. In the Web interconnection model, revenue is derived

from both the originating and terminating networks. As shown below, the

browsing party (analogous to the calling party) pays its ISP to get access

to the Internet. The browsed party (analogous to the called party) pays

its ISP to make its Web site accessible to all browsers on the Internet.

In turn, both ISPs pay a wholesale IP network operator for access to the

Internet.

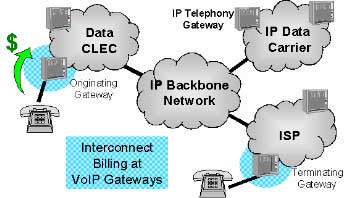

IP Telephony Interconnection

The IP telephony interconnection model is a combination of both the

circuit-switched and Web interconnection models. At the IP network

level, interconnection between the IP networks is the same as the Web

interconnection model. Smaller IP networks pay for access to an IP

backbone network.

As shown above, layered on top of the IP infrastructure are VoIP (voice

over IP) gateways located at the edge of the IP network. These gateways

convert telephone calls into IP packets for transmission across the IP

network. In a typical scenario, a telephone call will be received by an

originating VoIP gateway. The originating gateway will convert the

telephone call into a stream of IP packets that are transmitted across the

IP network to a terminating gateway. The terminating gateway receives the

IP packets and completes the telephone call to the called number. The

entire voice over IP segment of the telephone call is transparent to the

calling and called parties.

Like the traditional circuit-switched interconnection model, all

Internet telephony service revenues are generated by the calling party.

Also, like the circuit-switched interconnection model, network operators

will not complete calls on behalf of other firms unless they are

compensated for the use of their network. The Web interconnection model

ensures that the IP backbone operator is compensated for the IP traffic it

exchanges with the originating network operator. However, the Web

interconnection model offers no means for the terminating VoIP operator to

be paid for accepting the VoIP packets and completing the telephone call.

As a result, IP clearing and settlement are even more fundamental

commercial requirements for voice over IP networks than they are for

circuit-switched networks.

VALUE PROPOSITION FOR IP CARRIERS

There are several reasons IP clearing and settlement is an attractive

proposition for IP carriers (IP backbone operators):

- The IP infrastructure of these firms is well suited for handling IP

voice and fax with an acceptable quality of service.

- IP carriers are seeking ways to stimulate demand for their core

service -- wholesale IP bandwidth. Clearing and settlement is a

critical commercial enabler for IP telephony applications, and these

applications will increase demand for wholesale IP bandwidth.

- Clearing and settlement services enable IP carriers to provide their

service provider customers (ISPs, ITSPs, and CLECs) new value-added services.

Furthermore, by clearing and settling inter-network IP voice/fax

traffic, IP carriers can effectively charge higher rates for voice/fax

traffic than for commodity IP data traffic.

- An IP carrier's installed base of ISPs and CLECs represents an

existing community of users who, with a small capital investment, can

immediately benefit from inter-network clearing and settlement by

offering new value-added voice/fax services to their customers.

(Clearinghouses can provide CDRs to ISPs, ITSPs, and CLECs for billing retail

customers.)

The IP telephony business model represents a significant value

opportunity for an Internet Telephony Service Provider (ITSP) in the U.S. market.

TAPPING EXCESS NETWORK CAPACITY

In the IP telephony model, 1.5 cents per minute* is the average of all

economic costs, fixed (gateways) and variable (bandwidth and LEC

termination). Economic costs are defined as accounting costs plus profit

margin. This point is important because the mesh architecture of an IP

network does not require direct interconnection between ITSPs to exchange

IP telephony traffic. Since ITSPs are fully interconnected, the market

opportunity for them to buy or sell excess capacity at marginal economic

costs (cost + profit margin) can be very efficient and profitable for all

participants.

The economic appeal of VoIP termination is driven by two factors.

First, the peak traffic load for the average ISP offering dial-up services

occurs in the evening. The peak for telephone traffic occurs during the

day when ISPs have excess capacity available. ISPs are a natural market

for offering VoIP termination services since their traffic loads are

asymmetric with telephony traffic. Second, ISPs generate approximately 1.5

cents per minute in gross revenue for dial-up services. This 1.5 cents per

minute in gross revenue must cover all network, marketing, and customer

service expenses. ISPs would not incur marketing or customer service

expenses for IP telephony termination services. Therefore, ISPs can profit from offering IP telephony termination

service at a price well below 1.5 cents per minute. This assumption is

even more compelling if the ISP offers VoIP termination services when it

has excess capacity available.

Tapping the value of excess network capacity is not a new concept for

circuit-switched telephony operators. Traditional telephone companies have

been profitably buying and selling excess capacity at marginal economic

costs for decades. We believe, however, that an IP architecture enables

the trading of network capacity between carriers at dramatically lower

transaction costs.

* The author arrives at this figure using

list prices from Level 3 (an IP carrier) and pricing from an

interconnection agreement between BellSouth and ICG Telecom Group. For a

full explanation of this cost analysis, see TransNexus' whitepaper "The

Value Of IP Clearing And Settlement," from which this article is

adapted.

Jim Dalton is CEO of TransNexus,

a leading provider of IP network clearinghouse solutions and products.

TransNexus offers a range of standards-based clearing and settlement

solutions and products for real-time authorization, routing, clearing, and

settlement of inter-domain voice/fax communications among VoIP carriers.

TransNexus' clearinghouse solutions and products are ideal for wholesale

IP carriers and IP backbone providers wishing to become a V/FoIP

clearinghouse and offer their ISP/ITSP/CLEC customers inter-carrier

clearing and settlement of VoIP traffic as a value-added service. With the

TransNexus range of clearinghouse solutions, IP carriers can leverage

their existing IP network into a wholesale telephony network, increase

bandwidth demand derived from wholesale telephony services, and offer a

more differentiated service.

|